From a financial standpoint, paying cash is still the cheapest way to buy a car. However, many people are reluctant to use large sums of cash to purchase a new car at today’s prices. To encourage sales, car manufacturers often offer low interest rate loans as well as lease options. So the question is, are you better off leasing or buying a car?

From a financial standpoint, paying cash is still the cheapest way to buy a car. However, many people are reluctant to use large sums of cash to purchase a new car at today’s prices. To encourage sales, car manufacturers often offer low interest rate loans as well as lease options. So the question is, are you better off leasing or buying a car?

To make that decision you need to understand the difference between buying and leasing and how each could impact your own financial situation. Then regardless of whether you buy or lease, you need to do some homework in order to get the best deal.

You get what you pay for.

The basic difference between buying and leasing a car is that when you buy you own an asset. You can sell it, trade it and generally get some monetary value out of the car. When you lease, you’re simply renting the car. The lease is designed to simply pay for the decrease in the car’s value (depreciation) over the term of your lease. Because lease payments only cover depreciation rather than ownership, they are typically lower than car purchase payments.

Drive on a budget.

At first glance, a lease may seem appealing, but despite the low monthly payments leasing can be a lot more expensive than you think. Many times leases can have hidden costs, both up front and when you turn the car in. Hidden costs can include mile overage fees, damage fees, administrative fees and taxes. Typically the worst candidate for a lease is someone strapped for cash and often times the lease is most appealing for the same reason. The risk is getting hit with hidden costs that you can’t afford. We recommend buying the amount of car you can afford if you are on a tight budget. There are many great deals on good, low-mileage used cars – many which come with warranties.

So, when is leasing a good idea? The easy answer is it’s better for people who want a new car every two to three years, enjoy the convenience of walking away from the car at the end of the lease, and don’t mind that it may cost more than buying and keeping a car for a longer period.

Do your homework.

Regardless of whether you lease or buy, determine your price before you go to the dealer. To determine what you want to pay you will need the following information:

- Dealer cost for the car – that’s what the dealer pays for the car minus any kickbacks

- What are other people paying for the car?

- Dealer inventories on your car. You’ll get a better price on a car that’s in heavy supply.

- Average rate for auto loans. Make sure that any dealer financing offered to you is in line with auto loan rates at local banks and credit unions. With a lease, make sure the interest rate (APR) on your lease payment is also line with these rates.

Your options come down to paying cash, taking out a loan or leasing. The following example illustrates the basic economics of leasing vs buying:

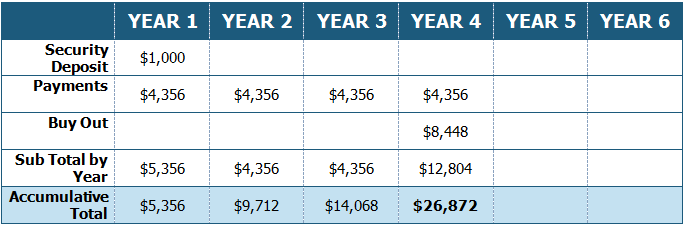

Lease:

Suppose that under one plan you can drive away in a new $24,000 automobile for a $1,000 security deposit and $363 a month for a 4 year lease. At the end of the lease, you might need another $8,448 to purchase the car outright.

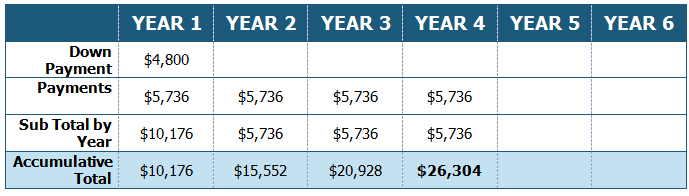

Purchase:

On the flip side, suppose you could buy the same car by making a 20% down payment ($4,800) and finance the remaining balance of $19,200 at an interest rate of 6% over four years for a payment of $448.

Lease (with buy out)

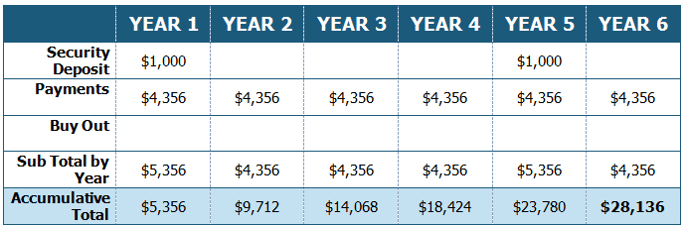

Lease (no buy out)

Purchase

Provided as a sample. Use at your own discretion. Birchwood Financial Partners, Inc. cannot be held responsible for information provided.

As shown above the least expensive option depends on how long you plan to keep your car. In years 1 – 3 leasing is the cheapest option. In year 4 the cheapest option is to finish your remaining lease and plan to lease another car. In year 5 and beyond, the purchase option quickly becomes the least expensive choice. At some point in the future you will need to replace your purchased car and the process begins again. Your numbers will be different than the above illustration but the math will likely remain the same. Make sure to check your numbers to see what option will work best for you.

Additional Things to Consider

How long you plan to hold your car matters. Here are some additional things you may want to consider before making a decision:

- Security Deposit - How much do you want to pay up-front? A deposit equal to 1 – 2 monthly payments is typically unavoidable and is applied to the lease. Watch out for large down payments and make sure to run your comparison.

- Early termination penalty - What will it cost to get out of the lease early? To keep monthly payments lower, some firms encourage you to take a longer lease than you need. Then they charge a large fee if you decide you want different car.

- Disposition charge - How much are the disposition fees? These cover the company’s cost of selling the car.

- Excessive wear and tear - What constitutes excessive wear and tear? Leasing companies must state the kinds of damage charges they may impose on you after the lease ends. Make sure the description is specific.

- High insurance charge – Leasing companies may make you carry higher coverage for collision, etc., which can be a lot more expensive that the average auto insurance policy.

- Residual Value - To get a good lease, go for a car with a high residual value. That’s what the car is worth when the lease is up. The higher the residual value, the lower your monthly payments (this assumes you don’t plan to buy the car you’ve leased which is often not a cost effective option).

- Excess mileage charge - Be realistic with your expected mileage usage. Going over the mileage terms can quickly get expensive.

Getting your next car doesn’t have to be about wondering whether you’re getting a fair deal. There’s plenty of good information available to negotiate a good deal. Knowing your financial situation and being realistic about how long you will hold the car will help you decide whether to buy or lease.