Market Insight - January 2016

In keeping a review of 2015 brief, I’m attempting to live by the wise words of Bambi’s bushy-tailed friend Thumper, “if you can’t say somethin’ nice, don’t say nothin’ at all”. While Birchwood enjoyed celebrating its 25th year in business, last year will go down as a disappointing one for investors. With stock and bond indexes ending the year roughly where they started, growth of invested capital was a struggle. Marked by a tepid first half of the year, markets sold off sharply during the third quarter only to recover much of the lost ground over the final two months of the year. Perhaps most memorable about 2015 from an investment standpoint was the wide anticipation that the Federal Reserve would raise the Fed Funds interest rate for the first time in nearly ten years. Since announcing the increase in the short-term interest rate, the S&P 500 Index of U.S. stock prices has lost over 12 percent of its value1 and long-term U.S. interest rates have actually fallen2.

It seems as though we can’t avoid spending time in each of these letters discussing interest rates. Now that the first rate increase is behind us, investors are turning to the pace and size of future increases as a signal regarding the health of the U.S. economy. This has been explored in previous letters, so we won’t belabor the point here, but we believe the Federal Reserve only increased rates to provide some flexibility to lower them if signs of an economic slowdown arise. To that end, the Federal Reserve has forecasted an additional four rate increases in 20163. We find that to be highly unlikely, but it is an aggressive position for the Federal Reserve to take and allows for relative monetary easing simply by dropping that forecast to three, two, one or no rate increases in 2016.

The global capital markets have started the New Year with a sharp decline the likes of which we don’t see often. At the time that this letter is distributed, most would characterize the markets as being in a sort of panic mode. Pinpointing what sparked the selloff is about as fruitful an exercise as trying to determine when it will bottom. We hope that our message of a disciplined adherence to a long-term investment strategy is helping to allay at least some of the angst that you may be feeling as stock markets falter. We’ve been living in a low volatility market for several years and that seems to be changing.

The obvious reaction is to move to safer options like cash or bonds and wait for the volatility to subside. After all, stock prices have been falling very recently showing that many investors are doing just that. It hurts to lose money and it comes with the nagging sense that you should have done something sooner or you second guess yourself. Remember that inkling that you had a week ago or six months ago that it was time to pull back on stocks – should you have listened to your gut and done something back then? Is it too late now? Are stocks going to keep going down from here?

We all experience those feelings in differing degrees. The difference between investors that have achieved good long-term investment results and those that haven’t is what actions are taken as a result of those feelings. We can do what we do with most other crises in our lives and take immediate action to alleviate the pain and bring reassurance that you aren’t going to be suckered by another stock market collapse. You barely made it through the last one and you can’t go through that again. If stocks continue to lose value in the coming weeks or months, the confirmation bias will set in and provide you with a sense of being right and that your actions were prudent.

If stocks move higher in the weeks and months ahead, you may find it difficult to reinvest in stocks because more downside may be coming.

This may sound familiar or not, but it’s what many investors are likely feeling right now. Those that aren’t having this struggle either aren’t paying attention or already took action to tourniquet the bleeding in their portfolio. Still others feel the struggle and the regret of an opportunity to have done something different in hindsight. That is the nature of investing and what makes it a difficult endeavor. As I say to high school students that are considering a career in investing, you need to get accustomed to feeling like you could have done something differently in the past. Even when you perform well, you will still have had the opportunity to perform better so even “wins” come with some sense of humility or what’s referred to as the “Monday morning quarterback” effect. Hindsight, as they say, is always 20/20 though. If you choose to invest by looking in the rearview mirror, you’re unlikely to be prepared for the next turn.

For these reasons it is so imperative to have a long-term strategy that allows us the ability to pull away from the crowd and realize that our investment goal isn’t to outperform over the next few days or even months. Included in our long-term strategy is the understanding that markets will experience periodic sharp setbacks and periodic exuberant ascents. What we know is that reacting to these events has been the folly of generations of unsuccessful investors over time. Preparing for the inevitable gyrations has been a cornerstone of generations of successful investors. We achieve this through diversification and rebalancing.

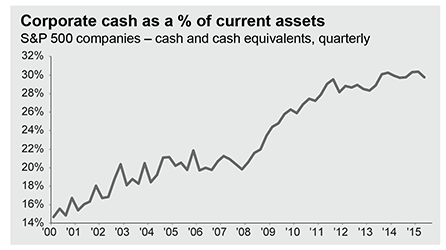

We aren’t trying to minimize the emotions that come with seeing your portfolio value go down, but rather to try to put it in context. Amid the market correction, there are still many reasons to believe that investors will be rewarded for staying invested over time. The global financial system is in better shape today that it was in 2008. Corporations are operating more efficiently than just about any time in history and have made fiscal improvements by reducing the carrying cost of what debt they have. In Graph 1, corporations have more liquid reserves to sustain a period of lower revenues. Households have also reduced debt, returned to the workforce and have seen the value of their home recover beyond the mortgage against it.

Graph 1

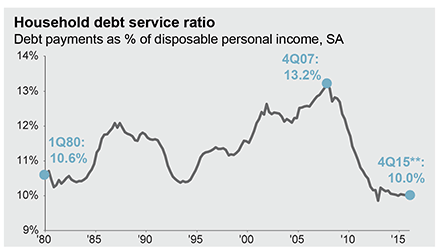

In Graph 2, observe that the burden of paying down debt is near the lowest level in over 35 years.

Graph 2

We selected these measures purposefully as the message we want to convey is that we are in better shape financially than we were leading up to the sub-prime mortgage crisis of 2008. If the start of 2016 is the beginning of a bear market, we expect that conditions are such that the severity of the 2008-09 bear market is unlikely to be repeated.

We are spending considerable time analyzing investments and attempting to understand the most probable direction of the markets so as to make course corrections to your portfolio. These course corrections work to tilt the portfolio one way or another, but are not meant to fully engage your portfolio for one potential outcome. We will not be consistently accurate in predicting the near-term direction of the capital markets, so we cannot stake your portfolio and your financial goals on something that amounts to a gamble. Your portfolio will always have diversification, which allows for reduced market risk as well as the opportunity to rebalance from outperforming assets to underperforming assets – also known as the practice of methodically “buying low and selling high”.

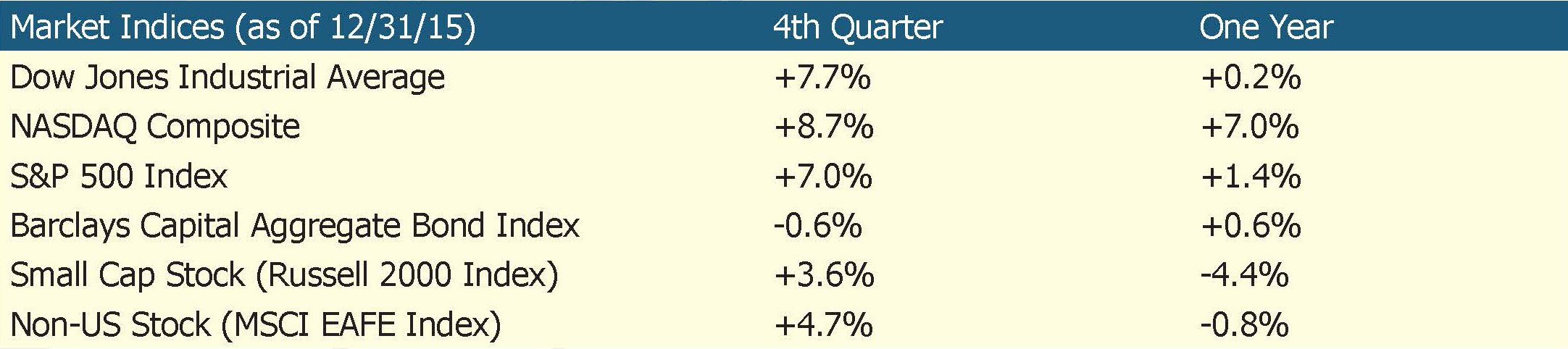

Table 1

We are more than happy to discuss your portfolio with you at any time. If you have questions or concerns about the recent market turmoil, please don’t hesitate to reach out to any of us. Additionally, please be sure to follow us on Facebook and LinkedIn.

Please keep an eye out for our February Newsletter that will more properly introduce Birchwood’s newest addition, Susan Larson. Susan joined Birchwood at the beginning of the year as our Administrative Assistant. You’ll likely see her smiling face the next time you stop in our offices.

Download Market Insight - January 2016

1 Source: Morningstar as of market close on January 15, 2016.

2 Source: Treasury.gov

Daily Treasury Yield Curve Rates as of January 15, 2016.

3 Source: FederalReserve.gov

Chair Yellen’s Press Conference on December 16, 2015.

Graph 1

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management

Graph 2

Source: FactSet, Federal Reserve Board, Bureau of Economic Analysis, J.P. Morgan Asset Management

SA – seasonally adjusted

**4Q15 household debt service ratio is a J.P. Morgan Asset Management estimate

Table 1

Source: Morningstar. Market indexes are unmanaged and investors cannot invest directly in indexes. However, these indexes are accurate reflections of the performance of the individual asset classes shown. All returns reflect past performance and should not be considered indicative of future results.