Love is in the air! You’ve met your soulmate and are starting to think about that next step toward your future together, which may or may not include marriage. There are many considerations and thoughts on whether or not “marriage” is the right step. One thing that may not come to mind is how marriage impacts your taxes. In general, getting married can have a positive effect on your taxes but so much depends on other factors which we will discuss below.

Love is in the air! You’ve met your soulmate and are starting to think about that next step toward your future together, which may or may not include marriage. There are many considerations and thoughts on whether or not “marriage” is the right step. One thing that may not come to mind is how marriage impacts your taxes. In general, getting married can have a positive effect on your taxes but so much depends on other factors which we will discuss below.

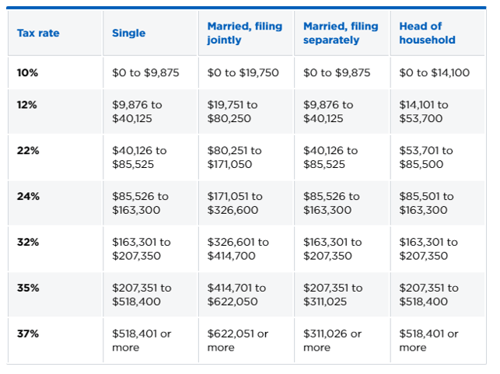

Tax Brackets

First, it’s important to understand how tax brackets work and what the differences are depending on whether you are married or single or have another filing status. Each tax bracket shows the tax rate you will pay on each portion of your taxable income. For example, if you are filing as a single taxpayer, 10 percent would be applied to the first $9,875 of taxable income you have. The next portion of income up to $40,125 would be taxed at 12 percent and so on. It’s important to note that “taxable income” is your total income less your deductions (either standard or itemized). The table below shows the different brackets for each filing status. Notice the rates are the same BUT the amount of income taxed at each rate is very different for each. For purposes of this article, we will mostly focus on Single vs. Married, Filing Jointly.

Single – You must file as single if you are not married by December 31st.

Married, Filing Jointly – You are able to file a joint return if you are married by December 31st. You may also use this filing status for the year in which your spouse dies. If you have dependent children, you qualify for two additional years as a widow(er).

Married, Filing Separately – You are married but file separately if you want to be responsible for your own tax liability and not your spouse’s.

Head of Household – If you are not married by the end of the year but you have qualifying dependents at home, you can file as head of household.

Table 1

2020 Federal Income Tax Brackets

As we can see from the table above, Married, Filing Jointly tax filers have more room within each bracket. You might assume that Married people pay less in tax. That is not necessarily true in every scenario. It depends on many different variables which we will continue discussing below.

Marriage Penalty?

The Tax Cuts and Job Act, which took effect in 2018, adjusted the tax brackets for Married couples so that “effectively” you weren’t paying MORE in taxes because you got married and now have combined incomes. This essentially worked for taxpayers in lower tax brackets (32 percent and below). For couples who each have high incomes ($400,000+) you may, in fact, pay more tax as a married couple because together you’d push into the 37 percent tax bracket (vs. 35 percent as a single). However, there are more things to consider than just your income alone.

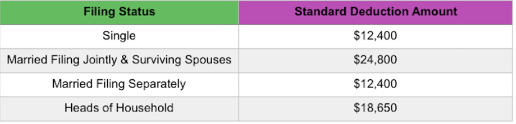

Standard Deduction and/or Itemized Deductions

Individuals and couples are able to claim a standard deduction OR an itemized deduction (whichever is greater). For the vast majority of households, the standard deduction is often used and is far easier. Here are the standard deduction amounts for each filing status for 2020:

Table 2

2020 Standard Deductions

- The standard deduction is $1,300 higher for those who are over 65 or blind; it’s $1,650 higher if also unmarried and not a surviving spouse.

- If someone can claim you as a dependent, you get a smaller standard deduction.

So if you are married and one spouse doesn’t work, you actually get double the standard deduction just for filing as a married couple, then you would have if you had filed as a single.

Now let’s discuss itemized deductions. The most common itemized deductions include:

- Medical expenses

- State and local taxes

- Mortgage interest

- Charitable contributions

Each of these itemized deductions is subject to different thresholds. These thresholds are not different for singles vs. married couples, but there are instances where filing as a single allows for higher itemized deductions. An example would be someone with high medical expenses because the amount in which you’re able to deduct is in excess of a certain percentage of your Adjusted Gross Income (AGI). Filing as a single may mean your AGI is lower which may make more of these expenses deductible to you.

Other Tax Differences that vary by filing status:

- Deduction of capital losses – Single filers can deduct up to $3,000 per year in capital losses. This deduction is exactly the same for married filers.

- Medicare surtax – Single filers can have up to $200,000 in income before the Medicare surtax kicks in. For married filers, this income limit is $250,000.

- Capital gain exclusion of a primary residence – The IRS allows single filers to exclude up to $250,000 of capital gain on the sale of a primary residence. Joint filers are able to exclude up to $500,000.

- Earned income credit – For lower-income earners, you may disqualify yourself from getting the earned income credit if you file jointly with a spouse that has income.

- Taxation of Social Security benefits - If you're single and earn more than $34,000 in combined income, up to 85% of your Social Security benefits could be taxable. For married filers, a combined income of $44,000 means that up to 85% of your benefits are taxable.

Other Considerations:

- Spousal/Survivor Social Security benefits – Spouses are eligible for spousal benefits in certain situations (meaning spouses can collect up to 50 percent of their spouse’s full retirement age benefit). Surviving spouses are able to keep the highest Social Security payment. You can read more in an article about the various Social Security eligibility of benefits HERE.

- Retirement contributions for non-working spouses – You’re able to contribute dollars to an IRA or Roth IRA for a spouse that is not working, assuming you have earned income for the household. There are different eligibility rules for each (see more in an article about Spousal IRAs HERE.)

- Estate planning – Spouses can inherit an unlimited amount of assets free of estate tax. This is called the unlimited marital deduction for estate tax purposes. Estate tax may, however, be owed on the death of the surviving spouse.

In the end, there is no one size fits all when it comes to taxes. Each person’s situation is very different. As financial advisors, we can help clients analyze and think through these pieces, and together with your CPA, we can help you understand all of the financial impacts of big decisions, like marriage.

References:

Table 1: https://www.nerdwallet.com/blog/taxes/federal-income-tax-brackets/