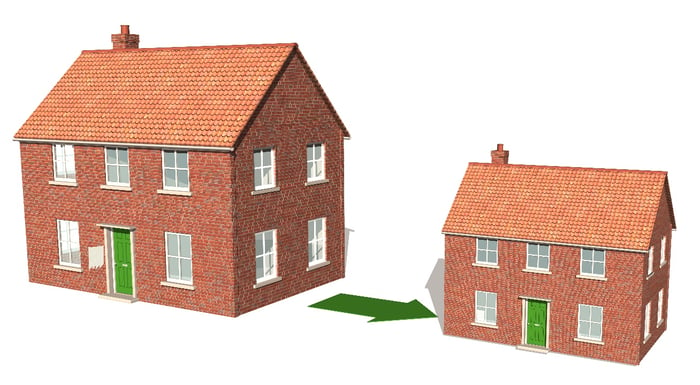

Many of our clients tell us they are considering downsizing in retirement. They may even be counting on selling their house and banking some of the equity when they buy a smaller home. Rarely do we see it actually play out that way.

Many of our clients tell us they are considering downsizing in retirement. They may even be counting on selling their house and banking some of the equity when they buy a smaller home. Rarely do we see it actually play out that way.

Consider a situation like mine. My husband and I live in a 40-year-old house that will need a lot of maintenance going forward. The yard is big, which is perfect for small children. However, our kids have left the nest and neither of us enjoy maintaining a huge yard. Time to downsize, right?

We’d love a one level townhome with green space in the back that someone else maintains. A newer construction so it doesn’t need expensive repairs. Preferably not in our current suburb, where we have to drive everywhere, but in a cute neighborhood where we can walk to shops and restaurants. Unfortunately, I just described what a lot of boomers want, and therein lies the problem. For us, downsizing means moving to a home that may cost twice as much as our current home! So much for banking some of the equity in our house.

There are a lot of things to consider when downsizing – or perhaps right-sizing – in retirement. Some of the considerations are noted below.

Financial Considerations of Moving from a House to a Town House or Condo

Preparing to sell. First, what do you need to do to your current house in order to get it ready to sell? Do you just need to clean the carpets, or do you need to do a bigger project like re-roof the house? Be sure to factor in these repairs in considering what you will net from the proceeds of selling your home after you factor in repairs, realtor fees, loan payback, and closing costs.

Cost of your new home. Will you be able to sell your house, buy a less expensive one and put money into your investments to help fund your lifestyle? Or like me, will you be looking at a more expensive home and have to budget in a mortgage?

Moving costs. Don’t forget the cost of the move itself. The prices can range from a few thousand dollars to hire some muscle, to five figures if you have the movers pack you up.

Furniture. Also, consider your living room furniture. Will that fit into your new home? Most of the time when our retirees move to a new place, they end up buying all new furniture. Sometimes it’s because their furniture was old and needed refreshing, but often it’s because the furniture from their house doesn’t fit into their new place.

Differences in property tax. I live in a county with a low property tax bill. The location where I want to live with the cute shops and restaurants is in a county with a high property tax bill. I would need to factor that difference into my overall budget.

Additional costs. In moving to a townhome or condo you also need to factor in an association fee. These cover different items but can include: snow removal, trash, exterior insurance, and lawn care. In a condo, the homeowners association also includes the building maintenance, garage, gym, hallways, etc. Homeowners’ association fees can range from several hundred dollars to $1,000 or more, depending on the location and the type of building you are buying into. There can be some offsets, such as you may not have a city trash bill anymore, but often you do end up paying more for the convenience of not dealing with the lawn and snow. If you are increasing your overall cost of housing, make sure it fits into your overall financial plan and that you can afford it long-term.

What if you are Moving out of State?

Perhaps you live in an area that’s subject to things like the Polar Vortex. Even die-hard Minnesotans have entertained visions of moving to a warmer part of the country. Minnesota is a pretty high-tax state so just about anywhere will be cheaper. Or will it?

Things to consider are:

- State income tax. Nine states do not impose any income tax as of 2023: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming. New Hampshire only taxes dividends and interest, not earned wages income1.

- Some states tax Social Security income and some don’t. Minnesota and ten other states still tax Social Security, which will eat into your budget. The taxing states include Colorado, Connecticut, Kansas, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, and Vermont2.

- Some states don’t tax Government pensions. Most states tax these pensions, but 14 states exclude all federal, state, and local pension income from taxation3.

- Property taxes. Minnesota’s property tax is fairly middle-of-the-road. Check out the cost of the tax where you are thinking of moving.

- Sales taxes. Minnesota’s sales tax is 6.875%, but when you consider there is no tax on food, clothing, or medications, it ends up on the reasonable side4.

- Costs of gas. Some states have a higher gas tax than others. If you will be driving a lot where you are going, be sure to check out the costs of gas.

- Costs of food. For example, Hawaii seems like a dream until you stock up on groceries.

- Cost of insurance. Moving to a warm location like Key West sounds lovely until you consider the cost of insuring a home down there.

What are Some of the Non-Financial Considerations?

Money is just one component of the overall move question. Are there things you’ve been wanting to do or hobbies to take up that you don’t have time for because your current home takes so much of your time? If so, downsizing to a less time-consuming home could be a plus for your overall life satisfaction. Other things to consider are the locations of the services you need and the shops you frequent. How good is the medical care? How about the availability of hairdressers and mechanics? Can you walk to a farmer's market? Is your church nearby?

While many people downsize their homes in retirement, they stand to make the adjustment easier if they’ve considered all the factors and run the numbers so they have a good idea of how the new home will affect their budget. Change is inevitable. Being ready for it can help ease the transition.

1 https://money.usnews.com/money/personal-finance/taxes/slideshows/states-with-no-income-tax

2 https://www.investopedia.com/which-states-don-t-tax-social-security-5211649#toc-the-bottom-line

3 https://worldpopulationreview.com/state-rankings/states-that-dont-tax-pensions

The states that exclude all federal, state, and local pension income from taxation on Government Pensions are: Alabama, Alaska, Florida, Hawaii, Illinois, Mississippi, Nevada, New Hampshire, Pennsylvania, South Dakota, Tennessee, Texas, Washington and Wyoming.