Market Insight - October 2025

Over the past several months, I’ve received requests to share our thoughts about cryptocurrencies, such as bitcoin and ether. The topic is admittedly daunting to summarize due to its complexity and continued evolution. Since we may write about cryptocurrencies as an investment opportunity more in the future, I will do my best to be concise and avoid too many tangents or rabbit holes. A warning for the intellectually curious, those rabbit holes may consume you. How should I start? At the beginning I suppose.

Understanding Blockchain Technology

Cryptocurrencies utilize blockchain technology. What is blockchain technology? Imagine a spreadsheet that’s shared across thousands of computers around the world. Every time someone makes a transaction, it’s recorded in this spreadsheet. Once a transaction is added, it can’t be changed or deleted. Transactions are bundled into a “block,” and these blocks are linked together in chronological order—forming a “chain.”

For another analogy, think of blockchain like a checkbook that everyone in a community can see. When someone writes a check, it’s recorded publicly. Each checkbook represents a block, and each checkbook or block is linked together. Everyone agrees on each transaction, and once it’s written down, it’s permanent. No one can go back and erase or alter it. This transparency supports trust among participants without needing a central authority like a bank.

Blockchain technology is the foundation behind cryptocurrencies like bitcoin and ether. Cryptocurrencies are the uniform means of exchanging money on a particular blockchain platform. For example, ether is the cryptocurrency native to the Ethereum blockchain. There are thousands of cryptocurrencies in existence today, each available to be bought and sold and each intended for different purposes. The purpose may be to reduce intermediary costs associated with traditional financial transactions, speed up transaction processing times, or ensure a reliable and secure exchange of money.

How Bitcoin Fits In

Bitcoin has emerged as the predominant cryptocurrency. The purpose of bitcoin is to facilitate the exchange of money anywhere in the world without the involvement of traditional financial institutions, such as banks. It uses blockchain technology to allow for the direct exchange of money between two parties. All that’s needed is an internet connection. Somewhat similar to mobile payment services like Venmo, but with Venmo you need to connect to a traditional financial institution like your bank account or credit card to process a money transfer or payment. Since the blockchain technology that supports bitcoin is just computer code, there isn’t a central institution or third-party that gets involved in a bitcoin transaction. No need to rely on a bank to facilitate your transfer of money.

Why Bitcoin Was Created

Relying on your bank to facilitate the transfer of money may not seem like a big risk to us now, but during the Great Recession in 2008 when large financial institutions were at risk of collapse there was borne the idea of a better option that takes the institutional financial system out of the mix. Likewise, in other parts of the world, trust in financial institutions is lacking, leading some to seek alternative means for transferring and storing wealth.

New Access Through ETFs

I’m going to dodge a rabbit hole here and not go too deep into the inner workings of bitcoin, or any other cryptocurrency for that matter. There are plenty of resources available to learn more about what makes bitcoin unique, including how a bitcoin is created. Until recently though, the process of buying bitcoin was complicated, costly, and risky for the average person. New this year is the ability to buy shares of an exchange-traded fund (“ETF”) that holds cryptocurrencies, such as bitcoin. An ETF is a security that trades on the open market, like a common stock. This development has made ownership of certain cryptocurrencies as an investment opportunity considerably easier. While not direct ownership of the cryptocurrency, ETFs provide an investor with the opportunity to participate in the changing value of a cryptocurrency such as bitcoin.

Bitcoin as Digital Gold?

Bitcoin has been likened to gold in that it’s a commodity that can be used as a store of value and means of universal exchange. While we aren’t transacting in physical gold anymore, we continue to assign inherent value to the precious metal due in part to its scarcity. Bitcoin was designed to have a fixed lifetime supply, also creating an element of scarcity and prompting some to refer to it as digital gold. Bitcoin is seen by some as the next evolution of money, improving on the deficiencies of fiat currencies like the U.S. dollar. While fiat currency has a fluctuating supply and relies on faith in the issuing government, bitcoin has limited supply and does not rely on any government or central authority.

Bitcoin proponents point to its scarcity as one of the key reasons why it has investment value. Economics teaches us that there must be demand for a scarce asset for it to have value though. Just because something is scarce doesn’t make it intrinsically valuable. So, why is bitcoin in demand? In my estimation, much of the demand comes from a network effect, or the general expectation that bitcoin may be invested in or used by more people and businesses in the future. This collective belief that it’s a legitimate asset that may ultimately be used by more investors as a hedge against inflation or to protect against devaluing fiat currencies may be reaching a critical mass, thereby making it self-fulfilling. After all, what makes the paper money I carry around with me have value? It’s that we all have agreed that it has value. If bitcoin is collectively believed to serve as a reliable inflation hedge in investor portfolios, its value will likely be correlated to changing inflation expectations.

Is Bitcoin an InFlation Hedge

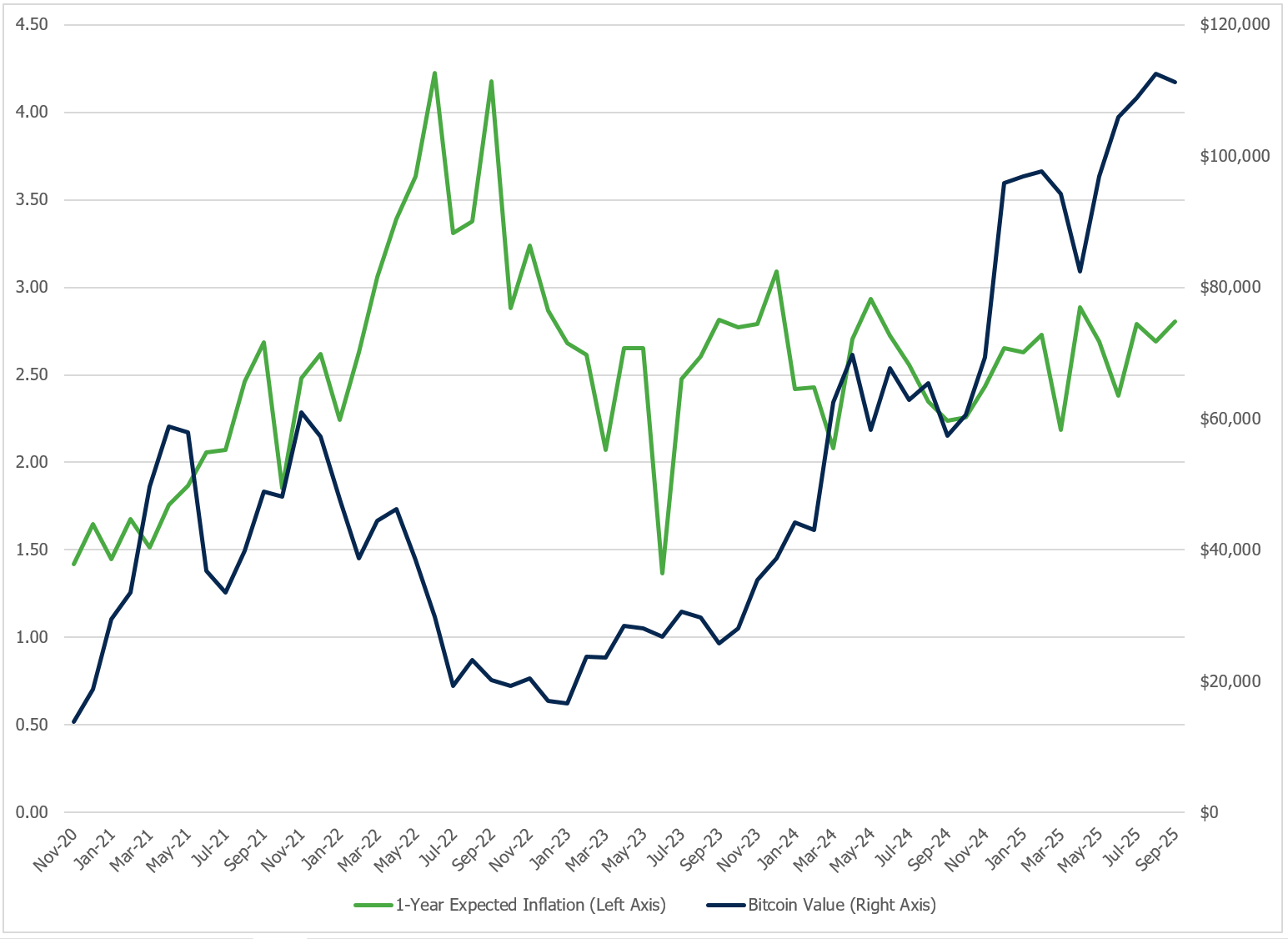

The reality is that bitcoin has not been an effective hedge against changes in inflation expectations. The observed relationship between inflation expectations and the value of bitcoin has not been favorable. In 2022, inflation expectations shot higher, and most assets lost value, including bitcoin. In fact, during the period that inflation expectations more than doubled from under 2% to over 4%, bitcoin lost 38% of its value1. While this is only one observation, it has been the only period of significant inflation since bitcoin came into existence. Somewhat paradoxically, bitcoin also traded 10% lower during the ensuing period when inflation expectations fell back to below 2%1.

Chart 11

We often say that stocks tend to be a good hedge against inflation, but this is with respect to the long-term effect that inflation has on purchasing power. Gold, Treasury Inflation Protected Securities (“TIPS”), and real estate also tend to provide positive long-term returns on an after-inflation, or real, basis. These relationships don’t necessarily hold true during acute changes in inflation expectations or over short periods. It is this type of role, as a long-term inflation hedge, that cryptocurrencies like bitcoin may end up having. In this respect, bitcoin has produced long-term returns well above inflation but so have stocks and particularly tech stocks.

Comparing Bitcoin and Tech Stocks

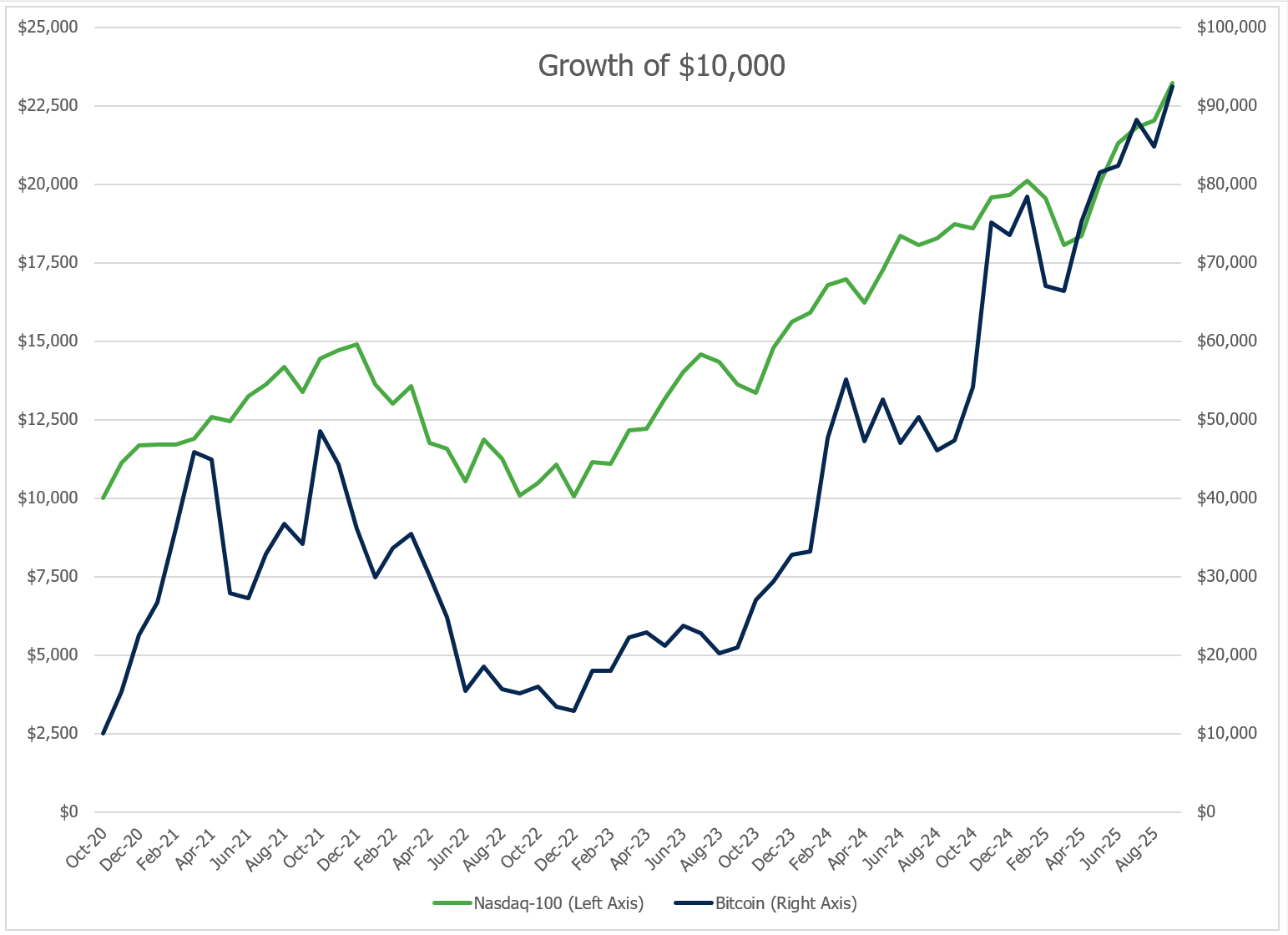

Over the same period shown in the chart above, we reviewed the performance of bitcoin versus the tech-heavy Nasdaq-100 Index. In the chart below, we can see that the price of bitcoin has followed a pattern more like a tech stock.

Chart 21

One reason why bitcoin may be trading in a pattern that resembles a tech stock is that it represents a technological advancement in money transfers. Investors are anticipating broader adoption in the future, an expansion of the network effect, thereby increasing the value of bitcoin. While this is a possibility, there remains a good deal of complexity involved in buying and owning actual bitcoin that would be used to transfer money. The counterargument here is that there have been and will continue to be advancements in making this process easier. Additionally, younger generations tend to be more adept at learning and using new technology and may be more willing to adopt bitcoin as a means of storing wealth. For these reasons, we remain open-minded about the potential for cryptocurrencies as an investable asset.

Keeping an Open Mind, but staying disciplined

While bitcoin may share some similarities to physical gold, we have yet to observe that it should be treated like gold from an investment standpoint. If bitcoin continues to be adopted as an alternative to storing wealth in a fiat currency like the U.S. dollar, we anticipate that it will take on more of the performance characteristics of physical gold. Should we see that trend develop, there may be an opportunity for bitcoin, or other cryptocurrencies, to become an addition to a long-term, diversified investment portfolio. Until then, we expect that cryptocurrencies will continue to trade more like a tech stock than a commodity. In that respect, we view stocks with tangible earnings and reasonably reliable expectations for future growth as more dependable long-term investments than cryptocurrencies that are heavily conditional on an expanding networking effect.

Here ends our crash course in how we think about cryptocurrencies as an investment opportunity. For those that were curious about cryptocurrencies and our stance on them as an investment opportunity, I hope this has been a helpful summary. For those clamoring to see bitcoin in their Birchwood-managed portfolio, I’m sorry to disappoint you. In our opinion, it remains a speculative investment that may provide swift growth but also may lose considerable value. These aren’t the types of assets we believe are prudent to own in a long-term investment portfolio. We do remain open-minded though and continue to follow the rabbit holes to look for different perspectives or ways of thinking about cryptocurrencies as an investment. Thank you for your continued trust in Birchwood. We look forward to sharing additional insights regarding this unique class of assets in the future.

Gratefully yours,

Steve Dixon, CFA®

Investment Manager

Dana Brewer, CFP®, Bridget Handke, CFP®, Damian Winther, CFP®, Rachel Infante, CFP®, Kimmie Andrews, CFP®, Kayla Berceau, CFP®, Brayden Kelly, CFP®

Sources:

1 Sources:

Federal Reserve Bank of Cleveland, 1-Year Expected Inflation [EXPINF1YR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/EXPINF1YR, October 22, 2025.

Coinbase, Coinbase Bitcoin [CBBTCUSD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CBBTCUSD, October 22, 2025.

Performance for the Nasdaq-100 Index provided by YCharts.

Bitcoin return calculations performed by Birchwood Financial Partners for the periods of October 1, 2021 to June 1, 2022 and June 1, 2022 to June 1, 2023.

Opinions expressed are not intended as investment advice or to predict future performance. No independent analysis has been performed. Investment decisions should not be based on information in this letter since the information contained here is a singular update, and prudent investment decisions require the analysis of a much broader collection of facts and context. All information is believed to be from reliable sources, however we make no representation as to its completeness or accuracy. All economic and performance information is historical and not indicative of future results. Asset allocation, which is driven by complex mathematical models, should not be confused with the much simpler concept of diversification. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. Rebalancing may be a taxable event. Before taking any specific action, be sure to consult your tax professional.