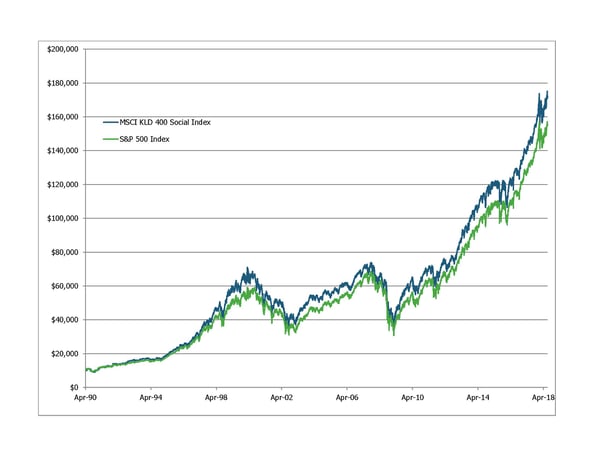

By now, the myth that responsible investing requires an investor to sacrifice returns in order to have their values reflected in their investment portfolio should be just that, a myth. Many studies have shown that using so-called non-financial factors in the investment decision-making process does not impair the investor’s ability to achieve a competitive return1. At a very cursory level and to save you from delving into these studies, take the following comparison between a stock market index that incorporates these non-financial factors (MSCI KLD 400 Social Index) and a stock market index that doesn’t (S&P 500 Index).

In this example, the MSCI KLD index is shown to outperform the S&P 500 Index over the past 25-plus years. While the result is conducive to dispelling the myth, I don’t want to make the argument for responsible investing to actually outperform traditional investing. Rather, I don’t believe that you need to sacrifice financial returns in your portfolio in order to feel good about how your money is invested.

The Non-Financial Factors of Investing

The non-financial factors that add to a more holistic understanding of an investment and its risks can generally be categorized in three buckets. There are Environmental, Social, and Governance factors, more commonly referred to as “ESG” factors. Each of these categories has real world examples where an investor’s disregard or under appreciation of these factors led to significant losses.

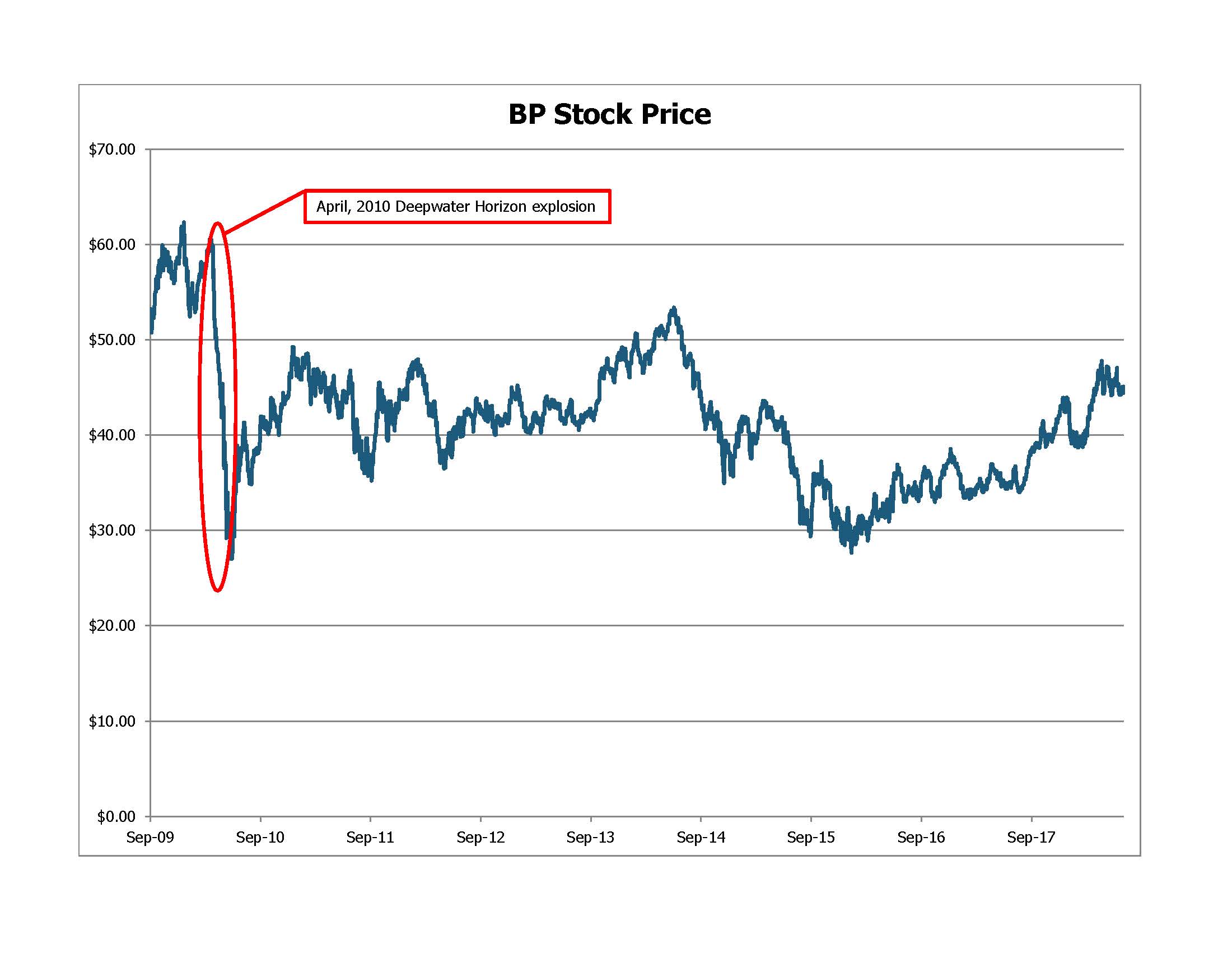

In 2010, an explosion on the Deepwater Horizon drilling rig in the Gulf of Mexico killed 11 workers and sent over 200 million gallons of oil gushing into the Gulf2. Investors in BP stock, the company operating the drilling rig, saw the stock price plummet in the days following the explosion. Over eight years later, the stock price has yet to recover to the level prior to the catastrophe. The total cost to BP as a result of the spill is over $50 billion3.

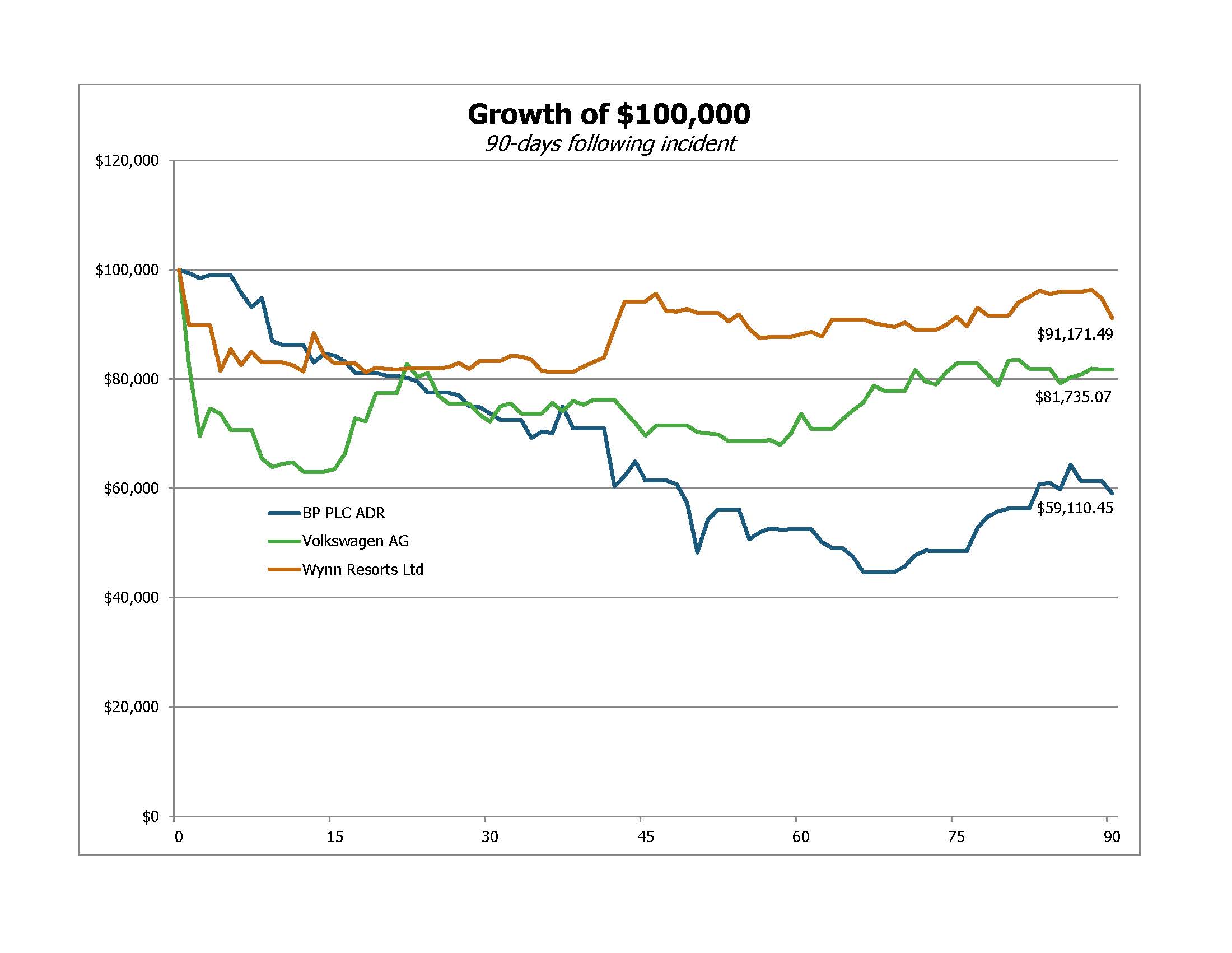

In January, 2018, the Wall Street Journal reported on allegations of sexual misconduct against employees by Steve Wynn, founder and CEO of Wynn Resorts4. The stock price for Wynn Resorts subsequently dropped nearly 20 percent in the following two days4.

In September, 2015, the United States Environmental Protection Agency issued a notice that Volkswagen had violated the Clean Air Act. The company had programmed vehicles to adjust engine performance when being tested for emissions, thereby appearing to have lower air polluting emissions. Volkswagen admitted to the deception on September 20th and the company’s stock price sank by 30 percent in the following two days5.

While attempting to understand a company’s environmental (e.g. BP), social (e.g. Wynn Resorts) and governance (e.g. Volkswagen) risks may seem irrelevant, clearly these examples prove otherwise. Responsible investing isn’t constrained to simply divesting from companies or industries that are deemed to be inconsistent with your personal values. It’s the integration of financial analysis and non-financial analysis to make more well-informed investment decisions.

How Funds Integrate with ESG Factors

When reviewing your next investment in a managed investment fund, such as a mutual fund or ETF, consider learning more about how that fund integrates these ESG factors into its investment process. We’ve listed below some good starting points for investors that are interested in seeking out funds that better integrate ESG factors into the investment process.

The impact that your investment decisions make reaches beyond your personal financial return. When you buy or sell a stock or a bond, you’re having an effect on the financing ability of that company. In the case of a stock, you are becoming an owner in that company and you have a right to vote on key matters associated with that company. The impact that your investments can have to improve a company’s environmental, social and governance practices can align with your personal values as a good steward in your community as well as contribute to improving the sustainability of that company and your investment.

Resources:

https://charts.ussif.org/mfpc/

http://www.socialfunds.com/funds/mfc.cgi

1 https://www.ussif.org/performance

2 https://ocean.si.edu/conservation/pollution/gulf-oil-spill

3 https://www.reuters.com/article/us-bp-gulfmexico-settlement-idUSKCN0PC1BW20150702

5 Morningstar, Birchwood Financial Partners.