Market Insight - November 2019

A friend of mine was telling me a story about his difficulty in getting his kids to do their chores around the house and I couldn’t help but see an analogy to investor behavior this year in the capital markets. He was telling me how his daughter’s one chore is to do the laundry. Unfortunately, she has a hard time remembering to do this chore and it is driving him nuts. He explained that he’d remind her repeatedly. He’d leave notes in her bedroom or in her bathroom. He’d set an empty laundry basket outside her bedroom door, only to later find the still empty basket slightly nudged aside allowing just enough space for a pair of child-sized legs to sneak past. After she’d finally do the laundry, she would neglect to remove the clothes from the dryer. Following a series of reminders he’d remove the clothes from the dryer, put them in a basket and place the basket on the stairs up to her room. Later that evening, after she’d gone to bed, he’d find the basket on the same step where he’d left it, but again nudged aside.

I could only laugh and commiserate with his parenting war story. After all, he’s not alone in expecting a certain outcome, but continually being disappointed. His tact in handling the situation is both comical and shows his gradual progression from gentle reminders to making her chore nearly (emphasis on nearly) unavoidable. I wouldn’t have been surprised to hear that he moved her bed to the laundry room to see if that did the trick.

In the past year through the end of October, the S&P 500® Index has gained 14 percent1. Underlying that 14 percent figure was a 16 percent drop in late-2018, followed by a 32 percent recovery over the course of this year. For much of that recovery period, financial headlines have been consumed by the U.S. tariff war with China, Brexit, slowing global economic growth, violent unrest in Hong Kong and impeachment. Indeed it has felt like the media keeps putting that empty laundry basket in the path of the stock market, only to have the stock market repeatedly nudge it aside and continue on its merry way.

Perils of Timing the Market

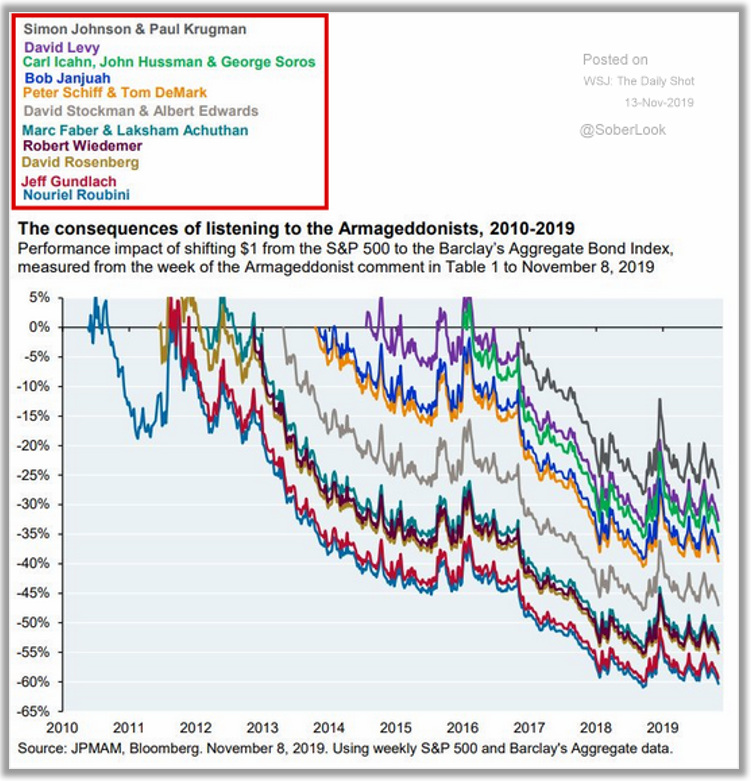

While there has been quite a lot of news that one would think should garner a negative reaction from the stock market, it has mostly been shrugged off by investors. While the obvious lesson to take from this experience is one that we’ve addressed in many prior letters, timing the market is exceptionally challenging. Take the following graph, published on the Wall Street Journal’s The Daily Shot blog. When we talk about timing the market, we are generally referring to an investor’s decision to be heavily invested in either stocks or cash given the current or expected market conditions. At times when an investor believes the stock market will rise in the near-term, they’d obviously move more of their capital into stocks. Conversely, if the expectation is that the stock market is poised to drop, they’d rotate out of stocks and into cash or a similarly low-risk investment. The following graph uses bonds in place of cash for a hypothetical illustration of the pitfalls of attempting to time the market. Each line represents how much less return an investor would have experienced if they would have heeded the foreboding advice of the market pundit listed and moved their money from stocks to bonds.

Chart 1

It has been fairly easy to devise or adopt a narrative that would prompt investors to lose confidence in the stock market. Earlier this year, we saw the yield curve for U.S. Treasury bonds invert. That is, the expected average return on longer-term bonds fell below the expected average return on shorter-term bonds. An inverted yield curve has widely been touted as a very reliable recession predictor. Likewise, the Institute for Supply Management survey of U.S. manufacturing executives, known as the Purchasing Managers Index, slipped below 50% this fall. With fewer than 50% of survey respondents reporting growth in manufacturing activity, this indicator has also been seen as a rather reliable indicator of economic weakness.

Recession Looming?

Allianz Global Investors publishes a US Recession Monitor report each month. The report uses twenty-two different indicators to generate three different recession probabilities. These probabilities are based on the idea that recessions happen for different reasons. In the most recent November report, the three probabilities are 1 percent, 45 percent and 87 percent. I find it difficult to offer a better encapsulation of the predicament facing market timing investors in the current environment. One set of recession-predicting factors implies smooth sailing while another set of factors seems to show that a recession within the next year is highly probable. If you are predisposed to believing that the markets are poised to drop, you may use the 87 percent probability to validate your thesis. Likewise, if your predisposition is that the stock market will continue higher, the 1 percent probability will justify your stock-heavy portfolio.

After such a long bull market, wouldn’t it be better to err on the side of caution and move investments out of stocks and into bonds or cash? Take your gains and wait for the market to drop? I’ll refer you back to the graph above to illustrate why this may not be the best idea. Some investors tend to equate investment risk with the volatility of the stock market. It is certainly true that stock prices fluctuate to a much larger degree than bond prices. However, with cash yielding below 2 percent2 and high-quality bonds yielding just over 2 percent3, you are most likely replacing the volatility risk of stocks with the purchasing power risk of cash and bonds if you decide to move your investments from stocks to bonds or cash. We believe a wiser approach is to attempt to balance your investment risks and stop trying to outwit the stock market.

While we do not believe that timing the markets is a fruitful endeavor, we do believe that it is important to seek an understanding for how the level of risk in different types of assets changes and seek ways to balance and mitigate these risks. As a result of central banks around the world intervening to stimulate growth, we are in an environment where investment risks appear to be elevated. We spend a great deal of time attempting to understand these risks, the interrelatedness of them and the methods by which we may be able to reduce them. We favor diversification and sticking to a disciplined allocation of your investments as a means to balance and reduce risk.

Instead of continually setting the laundry basket on the steps, expecting it to be picked up, its contents folded and put away, realize that that’s too often resulting in disappointment, frustration and an empty sock drawer. At some point that laundry will get done, but it could very well be when you don’t expect it.

Table 1

| Market Indices (as of 9/30/19) | 3rd Quarter | One Year |

| Dow Jones Industrial Average | +1.8% | +4.2% |

| NASDAQ Composite | +0.2% | +0.5% |

| S&P 500 Index | +1.7% | +4.3% |

| Barclays Capital Aggregate Bond Index | +2.3% | +10.3% |

| Small Cap Stock (Russell 2000 Index) | -2.4% | -8.9% |

| Non-US Stock (MSCI EAFE Index) | -1.1% | -1.3% |

Schwab Buying TD Ameritrade

You may have read that Charles Schwab Corp. has offered to purchase TD Ameritrade Holding Corp. This is a big development in our industry and one that we will be paying particularly close attention to in the months to come. As fiduciaries, we are charged with doing what is in your best interests and that is the lens that we will use when evaluating this potential merger and how it may affect the service that we provide to you. Stay tuned.

We wish you a safe and happy holiday season and are overjoyed and thankful that you have chosen us to be part of your lives.

Gratefully yours,

Steve Dixon, CFA®

Investment Manager

Kay Kramer, CFP®, Dana Brewer, CFP®, Bridget Handke, CFP®, Damian Winther, CFP®, Rachel Infante, CFP®, Stacey Nelson, CFP®

Download Market Insight - November 2019 (PDF)

Sources

1 Source: All returns cited for the S&P 500® Index are from Morningstar.

2 Source: “8 Best Money Market Accounts for November 2019.” Bankrate.com.; https://www.bankrate.com/banking/money-market/rates/; accessed November 25, 2019.

3 Source: SPDR® Bloomberg Barclays U.S. Aggregate Bond ETF Fact Sheet. https://www.ssga.com/doc/factsheets/FS1210_English.pdf, October 31, 2019. Yield to Maturity is 2.22%; accessed November 25, 2019.

Chart 1 Source: Borodovsky, Lev. “The Daily Shot: Heeding Financial Armageddon Predictions Can Be Costly.” The Wall Street Journal; November 13, 2019; https://blogs.wsj.com/dailyshot/2019/11/13/the-daily-shot-heeding-financial-armageddon-predictions-can-be-costly/; accessed November 13, 2019.

Table 1 Source: Morningstar. Market indexes are unmanaged and investors cannot invest directly in indexes. However, these indexes are accurate reflections of the performance of the individual asset classes shown. All returns reflect past performance and should not be considered indicative of future results.

Opinions expressed are not intended as investment advice or to predict future performance. No independent analysis has been performed. Investment decisions should not be based on information in this letter since the information contained here is a singular update, and prudent investment decisions require the analysis of a much broader collection of facts and context. All information is believed to be from reliable sources, however we make no representation as to its completeness or accuracy. All economic and performance information is historical and not indicative of future results. Asset allocation, which is driven by complex mathematical models, should not be confused with the much simpler concept of diversification. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. Rebalancing may be a taxable event. Before taking any specific action, be sure to consult your tax professional.