Each generation’s approach to retirement tends to be somewhat different from those of the previous generations. Although there are differences, there remain a lot of similarities:

- Concerns about future finances—will I have enough to support myself for 20, 30, or even 40 years after retirement? What about for others I may still be financially responsible for?

- Concerns about timing–Can I fill my time with activities and people that are meaningful to me? Will I stay healthy enough to live the life I am hoping and planning for?

- Concerns about community–Will I maintain or build a social community if I move or when I no longer see my co-workers regularly?

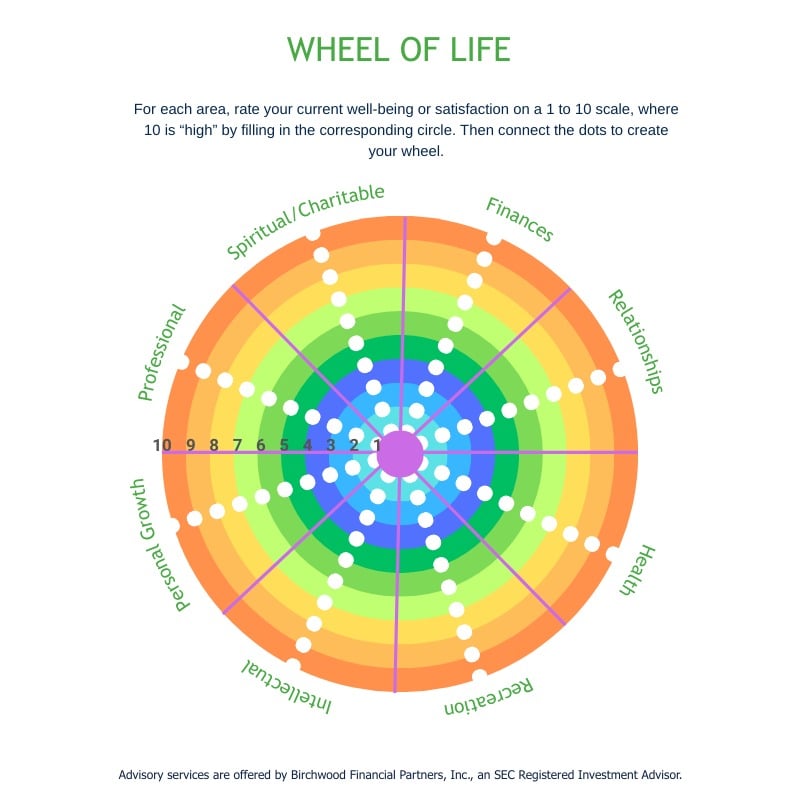

Retirement is a major life transition, so it is completely normal to feel overwhelmed by all there is to do and plan for, but start by meeting yourself where you’re at. Take a moment to reflect with our Wheel of Life to determine where you’re at with your retirement preparedness. This simple retirement planning worksheet can help you visualize which areas you feel good about and which areas you may need to work on.

The sooner you start planning, the sooner you can address your concerns so you can confidently say, “It’s my turn to do more of what I love!” come retirement.

In Your 40s

When we work with clients in their 40s, they are often heads down to their everyday demands. It is hard to think about planning for retirement when you may be trying to put your kids through college while working long hours in your career and possibly giving your parents your time. Planning at this stage involves:

- Health: Explore sports/exercise programs that you can play/do into your senior years.

- Relationships: If you have kids, prioritize time with your partner to stay connected when life’s demands pull you in many directions.

- Professional: Is this the career and the job you want for the next 20 years? Do you need to focus on your personal capital and make more money to accomplish your financial goals? What would it take to make the change

- Building your savings and investments: Look at retirement plan projections to see if you are on track to achieve your financial independence.

- Reducing debt: Make sure you plan to reduce your debt's cost and stick to that plan.

- Living within your means: Knowing how much you need to live off of in retirement starts now. Consider tracking your expenses and putting aside money for future needs.

- Recreation/Fun: Can you do activities with your partner or community to stay engaged with them?

In Your 50s

We are suddenly bombarded with reminders that retirement is around the corner. We started receiving flyers discussing AARP benefits, social security statements, retirement education invitations, etc.

Our reaction to these reminders about our encroaching retirement may span the "feeling" continuum from fear to curiosity to excitement. Like other stages in our lives (marriage, children, empty nesting, etc.), we are challenged to adjust to changes and re-orient our lives to incorporate the changes. In your 50s, it is time to reflect on how flexible or rigid you have been when change has happened and how you can prepare yourself for your next transition. Do you have sound support systems? Is there vitality in your life, or do you feel your life lacks purpose or meaning?

- Health: Continue to work on staying strong and fit. Your kids may be launched in this stage, so you can hopefully carve out more time for your health/fitness.

- Relationships: Discuss your feelings and concerns about retirement with your partner/friends. Inquire of your partner/friends about how they feel. How will your retirement time be spent – same as now or more time together

- Spiritual/Charitable: Pay attention to what fills you up spiritually. Start trying on charitable work and see what speaks to you.

- Professional: Explore options if you plan to career change or start a new business in retirement. Work on developing new skills for post-retirement work.

- Finances: Continue to check in on your expenses and retirement projections – make adjustments as needed to your investing and expenses.

- Intellectual: Take a class, do some historical travel, learn to play the piano, and challenge your brain while exploring places and topics you want to learn more about.

- Personal Growth: Travel to explore the world to help you get clarity about where you may want to live in retirement.

In Your 60s

For most of us, we will retire sometime in our 60s decade. We may experience the feeling of loss when we say goodbye to our colleagues friends and to a certain routine and structure to the life we have been living. We may feel the loss of identity that came from our work. We likely have some apprehension that comes with the uncertainty about what comes next regarding our health, finances, and activities. So, how can you lessen those feelings of loss and apprehension?

- Health: Staying strong is the number one way to avoid the risk of injury as we age. Invest in yourself with fitness or nutrition classes.

- Relationships: Try to expand your relationship base by cultivating new relationships. Try new social communities–art classes, pickleball, book clubs, travel groups, etc.

- Spiritual/Charitable: Get clarity on what charitable organizations you want to give your time and talent to and what volunteer roles fit you.

- Professional: Decide if you are done with work or will change careers. If consulting–work with a tax advisor to understand the self-employed world.

- Finances: Work with a financial advisor to understand how to design your retirement income plan. Tax planning will strongly influence how much to take from investment accounts, when to start taking Social Security, whether Roth conversions make sense for you, how and when to give from your IRAs to charities, and so much more.

- Intellectual/Personal Growth: What did you explore in your 50s that you want to spend more time doing?

- Recreation/Fun: What brings you joy? How can you do more of it? Does it help improve your physical or mental health, maintain and improve your relationships, fit within your budget, and help you grow and flourish in retirement?

There is no one model for retiring; you have options and can do it your way. Consider remaining in the workforce in a reduced or consulting role, retooling and starting a new business or profession, or returning to school just for the fun of learning. Figure out what volunteering opportunities are a fit for you. It’s your turn to do more of what you love and couldn’t do before.