While money can often be a stressor in our lives, women often report higher stress levels than men. We all have plenty to stress about from our jobs, to caring for family members, to balancing our budgets. It doesn’t mean we can’t learn to make some changes that may help ease the stress in our lives.

While money can often be a stressor in our lives, women often report higher stress levels than men. We all have plenty to stress about from our jobs, to caring for family members, to balancing our budgets. It doesn’t mean we can’t learn to make some changes that may help ease the stress in our lives.

Some reasons that women may feel more stress might be related to inadequate support at home, earning less at work and more care-giving responsibilities. Planning for retirement may seem like a far away concern but the sooner you start planning the more likely you will have a successful retirement.

Avoiding Self-Criticism

It is important to avoid self-criticism over not starting earlier or for your lack of understanding of the financial world. Our relationship with money can be one of the more complex psychological aspects of our lives. It is important to understand where your feelings are coming from and if you are worrying about things that may be out of your control.

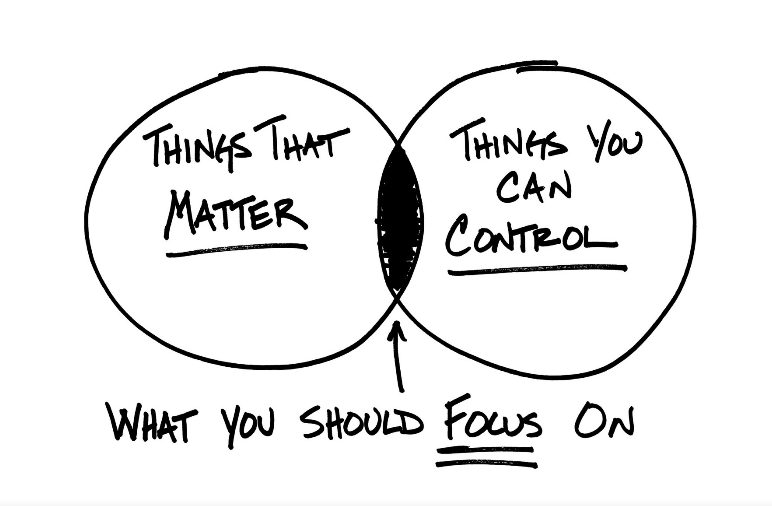

New York Times’ columnist Carl Richards uses two slightly overlapping circles to represent the universe of things that matter compared to things you can control.

Image 1

In the small overlapping space is where you find what it makes sense to focus on. This space is the things in your life that matter AND that you can control. When it comes to investing your money it usually means figuring out how to live on less than you earn and setting aside some money each paycheck to invest for your future.

That sounds simple but can be difficult. You may need to be able to understand where your feelings about money come from and understand if those feelings or behaviors are getting in the way of planning for your future.

For example, reactions to reminders about our encroaching retirement may span the feeling continuum from:

-

Fear (Too paralyzed to plan)

-

Denial (Not yet)

-

Anxiety (What must I do?)

-

Curiosity (What will life be like?)

-

Excitement & Anticipation (I can’t wait)

Those emotional responses and our ability to cope with the changes that come with retirement will depend on a number of variables.

-

How flexible or rigid are you when change is necessary?

-

How much support or isolation exists in your life?

-

Is there a sense of well-being or is your self-image negative?

-

Do you feel a sense of contentment with life? Is there vitality in your life? Or do you feel your life lacks purpose or meaning?

-

Are you running away from a job you don’t like or are you excited about the next chapter of your life?

So often our retirement preparedness focuses solely on financial aspects. Although we help clients daily understand what it takes to build their retirement nest egg we often see the non-financial variables affect whether retirement years are fulfilling. Variables such as psychological, social, family and certainly financial all need to be considered when planning for a thriving retirement stage of life.

Psychological

-

Loss – Saying goodbye to colleagues and friends, and to the routine and structure of the work world along with our work identity, which can often define our sense of worth.

-

Apprehension – Uncertainty about what comes next in regard to health, finances and activities.

-

Resentment and Anger – Because the aging population can be undervalued by our society, one may wonder if they can still contribute.

Social

-

If most of your friends are work friends, those relationships may diminish after retirement.

-

Are your friends retired or working? Will you have friends to go and “play” with?

-

Consider expanding your relationship base by cultivating new relationships through volunteering or picking up a new hobby.

Family

-

How do you and your partner/spouse actively and consistently include each other in your pre-retirement plans so they can align? Many couples figure out how to have separate interests and still find ways to stay connected.

-

How will it be to spend more time and space with your spouse/partner?

Financial

Will your resources be enough to give you the quality of life you want?

We consider retirement as not a single event but a process with several stages:

-

Stage 1: Planning phase/Imagination (15 – 6 years before retirement) – look at retirement scenarios. How feasible is your plan? In this stage people may have high expectations of adventure and empowerment.

-

Stage 2: Anticipation phase (5 years before retirement)

-

Taking classes to investigate new interests

-

Developing skills for post retirement “work”.

-

Remaining in the workforce in a reduced or consultant role. Because of impending labor shortages, employers will be motivated to retain older workers.

-

Retooling – retraining for another profession, starting a business.

-

Volunteer work.

-

What will my mental, emotional and physical health be at retirement?

-

Stage 3: Implementation Phase

-

Euphoria? How long does this last? Often not long.

-

Moving financially from Accumulation to distribution. Create your Retirement Paycheck: https://blog.birchwoodfp.com/i-set-my-retirement-now-what

-

Stage 4: Reality Phase

-

What can you do to avoid the risk of boredom, social isolation, or lack of mental stimulation?

Consider your many options and share these with your financial planner so your financial plan can align and support your unique and fulfilling retirement goals.

Sources:

Image 1: https://medium.com/@behaviorgap/worried-87cef9fef059