Minnesota hosted Super Bowl LII and introduced the world to the Bold North! As a resident, it was hard not to feel the camaraderie with your fellow Minnesotans, and you wanted the gear that showed it. Maybe for you it was more than just stopping by the nearest big box retailer for a mass produced product. Instead you decided to spend more at the local boutique because you wanted to support a small business, the product was made from recycled yarn and the company made a commitment to give 110 percent of the real climate cost of their business to organizations that are working to solve climate change.

Minnesota hosted Super Bowl LII and introduced the world to the Bold North! As a resident, it was hard not to feel the camaraderie with your fellow Minnesotans, and you wanted the gear that showed it. Maybe for you it was more than just stopping by the nearest big box retailer for a mass produced product. Instead you decided to spend more at the local boutique because you wanted to support a small business, the product was made from recycled yarn and the company made a commitment to give 110 percent of the real climate cost of their business to organizations that are working to solve climate change.

Maybe you were one of 200,0001 people who deleted their Uber accounts in early 2017 as a boycott of the company for continuing to operate services at JFK Airport, creating the perception that it was undermining a tax strike in protest of the immigration ban. The #DeleteUber campaign resulted in the company’s CEO removing himself from the position of economic adviser on the Strategic and Policy Forum created by President Trump.

Beyond Philanthropy: Socially Responsible Investing

You want to be proud of the ventures you support but philanthropy and public resources may not be enough. Private capital can help address pressing global challenges through Socially Responsible Investing (SRI). SRI has many labels—community investing, mission-related investing, green investing—to name a few, but ultimately they represent an investment strategy which seeks a financial return while bringing about a positive or environmental change.

SRI is Contagious

As of 2016, there were $22.89 trillion assets being professionally managed under responsible investment strategies, which is 26 percent of all professionally managed assets globally2. What is driving this growth? It is believed to be a result of a number of trends:

- Information is more accessible and investors are better educated and informed.

- Millennials and women are increasingly responsible for investment decisions and they recognize the power their investments can have.

- Choosing an SRI strategy does not mean that your performance will suffer for the sake of doing well. Performance for SRI strategies, like all investment choices, depends on what you buy and when.

Investment Strategies

If you’re considering making a socially responsible investment, it’s best to understand the different SRI strategies and philosophies. We will be discussing six of the most popular:

Activist Investing

Activist investing focuses on the rights of shareholders to bring about change to a company’s policies and operations. Proxy voting and shareholder resolutions are tools used by some funds in an attempt to influence a company’s management teams to take action on certain issues.

For example, Green Century Funds filed a shareholder resolution with Verizon Wireless in November to improve their commitment towards sourcing clean, renewable energy. In response, Verizon announced a new commitment to source 50 percent of its entire electricity usage from renewable energy sources by 20253.

Impact Investing

Impact Investing focuses investments into companies whose services or products target specific problems and challenges.

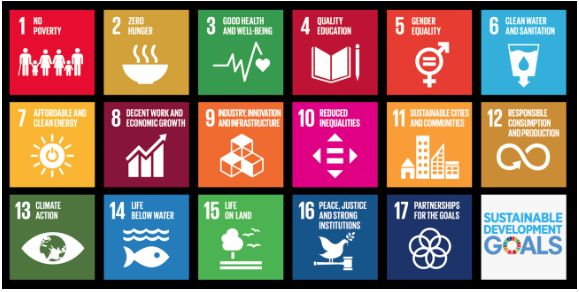

The United Nations has identified 17 Sustainable Development Goals to achieve by 2030 to define challenges to overcome in the world. The goals address global challenges, including those related to poverty, inequality, climate, environmental degradation, and peace and justice.

Graph 1

For example Goal 10: Reduce inequality within and among countries. While the international community has made significant strides towards lifting people out of poverty, there is inequality and large disparities regarding access to health and education services and other assets.

To read more about each of the 17 goals, visit https://www.un.org/sustainabledevelopment/sustainable-development-goals/

Negative Screens

Negative screening is the exclusion of sectors or companies in activities or industries deemed unacceptable or controversial.

For example, choosing not to invest in companies that manufacture guns or tobacco.

Positive/Theme Investing

Selecting investments specifically related to something deemed positive or sustainable.

For example, Gender Lens Investing generally means incorporating gender-based factors, to improve returns, reduce investment risk or to promote gender equality. Put another way, it means using capital intentionally to achieve positive impacts on women and girls. It means the integration of gender analysis into financial analysis to achieve better returns. In this approach, gender matters in the investment decision.

ESG Investing

ESG investing emphasizes environmental, social, and governance as the main criteria for gauging the sustainability of an investment. These non-financial factors are considered with the goals of avoiding undesirable behaviors or reducing portfolio risk:

- Environmental: issues relating to the quality and functioning of the natural environment and natural systems.

- Social: issues relating to the rights, well-being, and interests of people and communities.

- Governance: issues relating to the management and oversight of companies and other entities.

Religious Theme

Religious Theme investing includes investing in firms whose activities do not violate the tenets of a given religion.

Conclusion

Choosing how you would like to make a difference through SRI investing strategies is just one step. Working with a financial advisor and investment manager can help you build an SRI portfolio that fulfills your goals.

Sources

1 Source: Feb 2, 2017 Over 200,000 people deleted Uber after the company operated its service at JFK airport during the Trump strike. Business Insider

2 Source: 2016 Global Sustainable Investment Review. Global Sustainable Alliance

3 Source: Jan 18, 2019 We Hear You Loud and Clear: Verizon Sends Strong Signal to Renewables Industry, Green Century Funds

Graph 1: Sustainable Development Goals, United Nations