Market Insight - May 2021

There are few topics in economics that seem to be as widely misjudged and generate as much head-scratching as inflation. In its simplest form, inflation occurs when an economy has excess demand compared to the available supply. Of course, the U.S. and global economies are anything but simple. Instead, they are vastly complex, intertwined, in constant flux and are being influenced by both natural supply and demand dynamics as well as unprecedented government intervention. It’s no wonder that inflation remains a very difficult economic measure to predict.

We can further complicate matters by declaring that certain situations of inflation are likely transitory. These inflationary episodes are perhaps more a function of temporary supply or demand disruptions or other factors that can be reasonably expected to abate in the near future. Government officials and economists generally do not lose sleep worrying about transitory inflation. It isn’t even longer-term, sustained inflation that causes concern. It’s when an economy is faced with either high and sustained inflationary pressures or sustained deflationary pressures. Like Mama Bear cooking porridge for her little cub, the Federal Reserve and other central bank officials around the world want inflation to be just right. Too hot is not good and too cold can be worse.

Some Inflation is Healthy

We have all been trained to believe that just right inflation is around 2 percent per year. The Federal Reserve has deemed this to be a level of inflation that is low but stable and allows for predictability by businesses and consumers. Prices for goods and services that rise at a low and stable pace imply a steadily growing, healthy economy.

Concern that inflation may climb higher than the just right level has increased this year amid a confluence of circumstances. As mentioned earlier, inflation arises from excess demand compared to the available supply. Several elements are leading to higher expected demand, but most notably are the fiscal stimulus efforts by the U.S. government and the “reopening” of the economy as pandemic restrictions are relaxed or lifted.

There have been several measures taken by congress and executive action that have put money directly in the hands of U.S. businesses and consumers. Whether by direct support for the unemployed and middle-to-low-income households, moratoriums on payments and interest accrual on student loans, deferred tax collections, or housing assistance, fiscal stimulus during the pandemic has been substantial. All told, fiscal stimulus measures will amount to roughly $6 trillion1.

What Consumers are Doing with Their Stimulus Checks

Putting extra money in the hands of consumers doesn’t necessarily equate to higher demand though. Recipients might instead decide to save it or use it to pay down debt. In a recent survey from the New York Federal Reserve, “only about 25% of the checks are going to spending”2. The personal savings rate in the U.S. climbed to a remarkable 33.7 percent in April of last year during the first round of stimulus. In March of this year, the personal savings rate remained extremely high at 27.6 percent. These are by far the highest savings rates since records began in 19593.

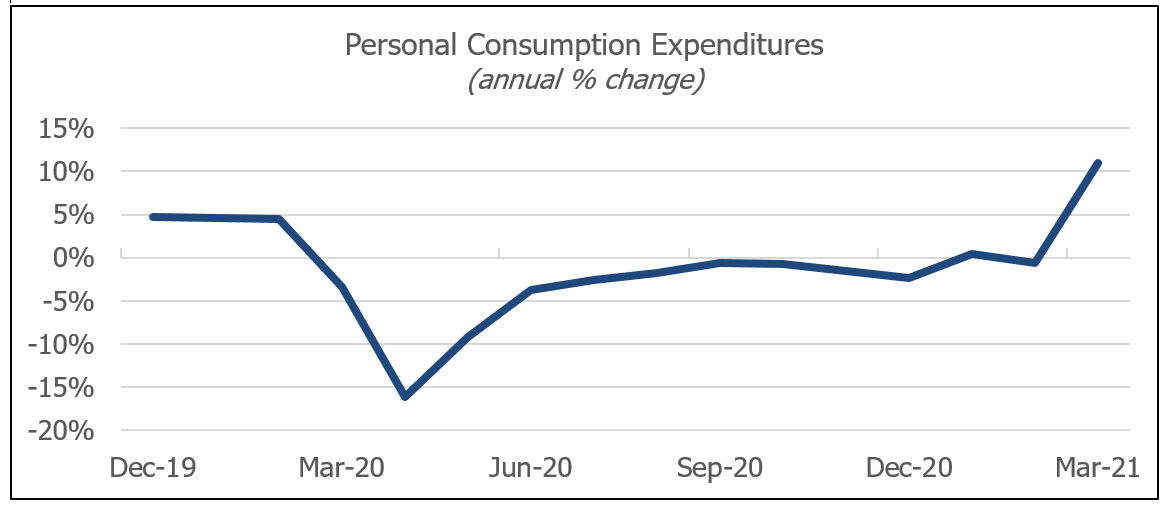

It is true that consumer spending has in fact increased, most recently rising over 4 percent in March of this year. Additionally, consumer spending has climbed nearly 11 percent over the past year (see chart 1)4. Remember that spending dropped dramatically in March and April of last year though, so it’s not terribly surprising to see that spending has increased from those depressed levels.

Chart 1

It certainly seems rational to expect that spending will continue to increase as more and more are vaccinated and capacity restrictions are lifted at restaurants, airlines, sporting events, and more. As economic activity recovers and infection rates dwindle, consumers are likely to feel more comfortable spending more, bringing the savings rate down. Additionally, the stock market and housing market have recovered sharply, which are larger components of high-income household balance sheets. The wealth effect caused by low interest rates and elevated asset prices should drive increased spending by the more affluent.

Shifting to the supply side, shortages in a wide range of items remain. The shortages are partly due to the pandemic and the reduced productivity that it caused and partly due to how quickly demand has been recovering. Production all but stopped a year ago in some industries and it takes time to ramp back up to meet changes in demand from businesses and consumers. Additionally, labor shortages are prevalent in many industries, which is hindering production.

Strong Deflationary Forces Remain

Right now, it certainly seems like we are set-up for higher inflation in the months ahead. Lack of sufficient supply, rising demand, and increased capacity for consumers to spend should make for inflation that we haven’t seen in the U.S. in decades. We haven’t even mentioned the stimulus that the Federal Reserve has enacted since a year ago March. While there is little evidence that there is a connection, direct or otherwise, between monetary stimulus from the Federal Reserve and higher goods and services price inflation, some suggest that combined with significant fiscal stimulus, higher inflation will be the result. There isn’t really a precedent for the combination of circumstances facing the U.S. economy at present. It will be important to stay open-minded and adaptable as the economy remains in familiar, but uncharted territory.

It is also important to be mindful of the substantial and unrelenting deflationary forces that remain in the U.S. and other developed economies. Primary among them are aging demographics and rapid technological advancement. Demographics in the U.S. are not supportive of a case for sustained high inflation. Historically, high inflation has tended to coincide with a fast-growing labor force where new workers outpace retiring workers at a healthy rate. The U.S. workforce is older and has only been growing at around 1 percent per year. Further, the workforce is only expected to grow by about 0.4 percent per year over the next decade5. The last time that the U.S. experienced high inflation was in the late-1960s and 1970s. The workforce was growing at about 2.6 percent per year on average during the 1970s6.

It is difficult to argue that technological advancements haven’t been deflationary. Anecdotes abound. In 1977, you could purchase the new Apple II computer for about $1,300. Today, you can buy a new iMac for the same amount. Technology has driven down costs across nearly all industries and contributed to increased productivity. Faster semiconductors and communication networks seem all but sure to continue this trend.

If you also consider the globalization of trade and competition, which is also deflationary, it is difficult to conclude that we are headed for high and sustained inflation in the U.S. Demand and supply dynamics in the near-term seem all but sure to incite higher inflation than the 2 percent just right level. At present, these do still appear to be what economists would describe as transitory though. Demand is likely to recover from the sharp drop in 2020 and perhaps overshoot, leading to higher spending. Adequate supply to satisfy rising demand may take time as global production and trade resume. This imbalance seems sure to wind up driving prices higher. At some point in the not too distant future though, these imbalances seem likely to settle. Between now and then, we expect higher volatility in interest rates and potentially other asset prices, such as stocks and commodities.

As mentioned earlier, it will be important to stay open-minded and adaptable to new information. Inflation has been confounding economists for quite some time. While we currently do not expect high and sustained inflationary pressures, we cannot be stubborn if our interpretation of the information begins to suggest otherwise. It is becoming more and more important to continually challenge assumptions and seek opinions from those that think differently or can provide a unique perspective. Our investment process includes bi-monthly meetings that are designed with this in mind. We invite two investment professionals from outside of Birchwood to discuss the markets, the economy and related long-term trends. We do this to help protect your portfolio from our own biases and to challenge our own narratives. Our conversations have turned to inflation many times over the years and have helped to form what is our current understanding of the topic.

Table 1

| Market Indices (As Of 3/31/21) | 1st Quarter | One Year |

| Dow Jones Industrial Average | +8.3% | +53.8% |

| NASDAQ Composite | +3.0% | +73.4% |

| S&P 500 Index | +6.2% | +56.4% |

| Bloomberg Barclays Capital Aggregate Bond Index | -3.4% | +0.7% |

| Small Cap Stock (Russell 2000 Index) | +12.7% | +94.9% |

| Non-US Stock (MSCI EAFE Index) | +3.5% | +44.6% |

In January of last year, Kimmie Moehring left to pursue another opportunity as a financial advisor. While we were saddened to see her go, we were also hopeful that she might return at some point in the future. I can’t tell you how happy we all were to welcome Kimmie back to Birchwood in February. Kimmie has a great sense of humor and brings a warm, kind personality that fits in very well at Birchwood. She is a hard-worker and is passionate about serving you, our clients, well. Kimmie has earned the Certified Financial Planner® certification and has spent the last year developing her expertise in all aspects of financial planning with some emphasis on tax planning. We are overjoyed to have her back at Birchwood as a financial advisor as she further strengthens our team and helps us provide you with the high level of service that we endeavor to deliver.

Be well and thank you for the trust that you’ve placed in us.

Gratefully yours,

Steve Dixon, CFA CSRICTM, Investment Manager

Kay Kramer, CFP®, Dana Brewer, CFP®, Bridget Handke, CFP®,

Damian Winther, CFP® CSRICTM, Rachel Infante, CFP® CSRICTM, Kimmie Moehring, CFP®

Sources

1 Source: Davidson, Kate, et al. “Third Covid-19 Stimulus Package Could Jolt U.S. Growth, Revive Inflation in 2021.” The Wall Street Journal, Dow Jones & Company, 10 Mar. 2021, www.wsj.com/articles/latest-stimulus-package-could-jolt-u-s-growth-revive-inflation-in-2021-11615372201.

2 Source: Lobosco, Katie. “Americans Are Spending Only 25% of Their Stimulus Checks.” CNN, Cable News Network, 7 Apr. 2021, www.cnn.com/2021/04/07/politics/stimulus-check-spending-savings/index.html.

3 Source: U.S. Bureau of Economic Analysis, Personal Saving Rate [PSAVERT], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PSAVERT, May 10, 2021.

4 Source: U.S. Bureau of Economic Analysis, Personal Consumption Expenditures [PCE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PCE, May 10, 2021.

5 Source: “Employment Projections: 2019-2029 Summary.” U.S. Bureau of Labor Statistics, U.S. Bureau of Labor Statistics, 11 Sept. 2020, www.bls.gov/news.release/ecopro.nr0.htm.

6 Source: Bureau of Labor Statistics, U.S. Department of Labor, The Economics Daily, Labor force growth: past, present, and future at https://www.bls.gov/opub/ted/2007/jan/wk1/art02.htm (visited May 11, 2021).

Table 1 Source: Morningstar. Market indexes are unmanaged, and investors cannot invest directly in indexes. However, these indexes are accurate reflections of the performance of the individual asset classes shown. All returns reflect past performance and should not be considered indicative of future results.