Life after retirement is both an exciting and challenging time. You’ve likely spent the last several decades surrounding yourself with structure, people, places, and things that made that alarm clock sound to get you on your feet for the day.

Maybe you’ve managed your time with agendas—outlining your days, weeks, months, and sometimes years. Maybe you’ve developed relationships with people with shared interests and experiences. When you’ve had a very distinct path and purpose, finding a similar routine and purposeful life after retirement can seem daunting.

That is especially true after the past few years, when there have been swings in our own personal economies and day-to-day living. The expectations for retirement, retirement timing, and even the definition of retirement itself have come into question for many Americans.

In the classic definition of retirement, you can imagine one day waking up with no schedule, no timeline, no one calling or emailing, and no real plan. Now, multiply that day by what could be another few decades. Suddenly the reality of life after retirement might become bleak.

So, how could you be filling your time in this next phase of life? Many haven’t thought about it, and they’re looking for the immediate relief a “schedule free” life is supposed to bring. But what do you do when that relief becomes boredom, which may lead to confusion, and potentially isolation and depression? How can you instead create that path and purpose again so that retirement brings happiness and fulfillment?

WORK ON DESIGNING YOUR NEW VISION:

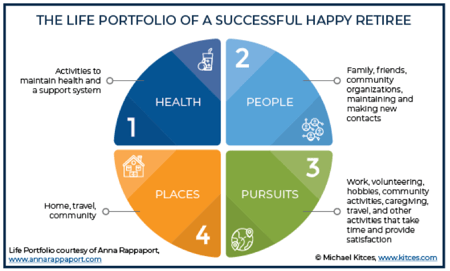

One of the most common retirement myths is that every retirement looks the same. Don’t think of your life anymore as a plan but more as a vision for how you want it to look and feel. You get to be the creator of your day, which means you are in charge of your pleasures and fulfillments. This vision should be a balance of both. Pleasures provide short term feelings, where fulfillments are longer lasting. To consistently fill your days with golf, travel, grandkids, etc. may only leave you partially satisfied. Another way to think about it is to create a well-balanced “life portfolio” like this illustration shows:

A successful well-balanced “life portfolio” might include spending more time with those you love, getting involved in communities you enjoy, exploring new hobbies, taking new risks, learning something new, traveling, finding ways to give back, and doing some level of physical activity if you’re able.

FIND YOUR MEANING AND PURPOSE AFter Retirement

As you work to fulfill your life portfolio, you will find there are things that provide more meaning and purpose than others. For some this may be the start of a new career. A career that achieves meaning rather than material success. Finding work or a new career after retirement can have many benefits. AARP recently pointed out that a post-retirement job can help pad your savings, keep your brain active, maintain a sense of community, and offer a chance to give back.

For others this may be found in volunteer opportunities, community engagement, or even part-time work. Being able to use a skill that’s adding value somewhere, somehow or spending time learning a new skill are a couple of other ways to channel your post-retirement energy.

When we find our meaning and purpose, we may no longer feel the need to pursue happiness, it just happens naturally. But finding a new purpose can take some time. Think through some of these questions as you start asking yourself what your next meaningful move is:

- What have I always thought about trying someday but never could find the time?

- What characteristics do I have that I feel add value in my life? How can those characteristics add value in someone else’s life?

- What skills can I use to help other people?

- When do I feel the most creative?

- How can I help to make the world a better place?

- What social or ethical issues are of importance to me?

- What typically motivates me?

- What would I regret not doing?

Retirement requires so much more than planning for it financially. It’s making sure you are emotionally, physically, and cognitively ready. Working with a financial planner that appreciates your complexities and helps to ask the right questions, can help you start to prepare and plan for your life after retirement.

Resources: