Market Insight - August 2020

We are all living disconnected lives right now. We are disconnected from each other, from our routines, and from our plans. It is ironic given how technology has advanced in such a way that we are all more virtually connected than perhaps ever before. For some, technology has helped retain that sense of connectedness, but for others technology has also added to the emotional strain by connecting us only virtually through the unfiltered spiderweb of social media. This year has tested our adaptability and our perseverance. It has tested our patience and resolve. We are reminded not to take our treasured relationships for granted.

Stock market recovery

Not surprisingly, the swift recovery of the stock market over the past several months seems to be starkly at odds with the state of limbo we all face each day. Over 17 million people remain unemployed in the U.S.1 and reported economic activity in the U.S. dropped by a remarkable, unparalleled rate of 9.5 percent during the second quarter2. For context, the worst quarterly contraction during the Great Depression occurred in 1937 when economic activity shrank by 7.2 percent2. Despite these overwhelmingly dismal economic realities, the U.S. stock market recovered by nearly 21 percent during the second quarter3, which was the best quarterly return since 1998 and brought the market to within just a few percentage points of where it started the year.

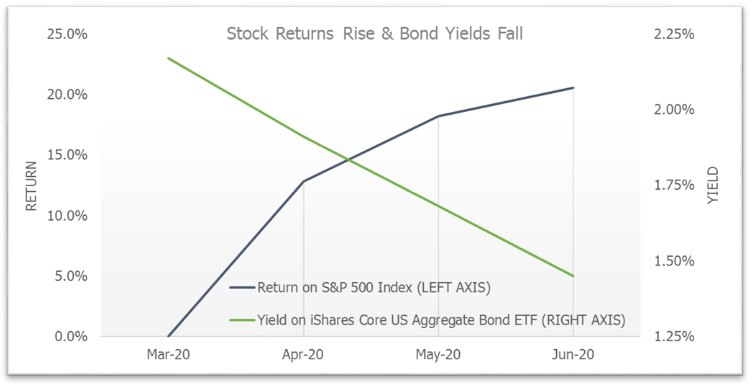

Increasingly, the stock market seems to be reflecting our hopes and dreams for the future, while the bond market is reflecting our fears. During the second quarter, as the stock market recovered, investors pulled over $109 billion out of stock mutual funds and exchange-traded funds. At the same time, over $187 billion was being added to bond funds4. Chart 1 shows the stock market rising during the quarter, while the yield on bonds dropped from 2.2 percent to 1.5 percent.

Chart 1

Yields on bonds are now below 1.5 percent. A 10-year U.S. Treasury bond is priced to yield just over 0.5 percent on average each year until it matures. Yet investors find these rates of return to be attractive enough to continue shifting assets from stocks to bonds. The appeal likely isn’t the return potential of bonds, but rather the lower risk profile of bonds.

Increase Demand for Safe Assets

The Federal Reserve is playing a large role in pushing interest rates down by buying bonds in the market, but it isn’t alone. Concerns about excessive stock valuations and slow economic growth were fairly prominent prior to the COVID-19 outbreak and drove investors to demand safe assets. As the “FAANG” stocks, represented by Facebook, Amazon, Apple, Netflix, and Google (trades under its parent company, Alphabet), surge to new highs, fears of excessive valuations have been renewed recently. Economic growth is sure to return, but it’s unclear when or how long it will take to recover to pre-COVID-19 levels. The demand for safe assets has been steadily strong for the past decade, pushing the yield on these assets to lower and lower levels.

We don’t see the demand for lower risk assets abating in any significant way for the foreseeable future. There is likely to be considerable uncertainty facing the economy and corporate earnings that will keep investors from fleeing the safety of bonds in a meaningful way. We don’t believe that rising stock values will entice investors away from bonds in a major way. In fact, what we’ve witnessed is that it may have the opposite effect as investors fear that stock prices are disconnected from reality and poised to fall. The consequence of continued high demand for lower risk assets is that returns on those assets, generally bonds, are likely to be below long-term averages. The cost of protecting a portfolio of investments is quite high and looks to remain that way.

Effect of Government Stimulus

Why then if the economy is in a state of suspended animation and investors are adding to bonds do stock prices continue to rise? This is likely the question on many minds. We don’t believe that the answer is necessarily simple or intuitive, which may make it difficult to understand. It may not be consistent with one’s interpretation of the current state of affairs, so it seems to be continually questioned in the media. In a world that is lacking growth, investors are left with few options to invest for attractive returns. Stocks are one of those options, but not all stocks. Stocks in countries, industries and companies that are expected to provide stronger growth are attracting investors in greater numbers.

Additionally, we were all reminded of the so-called Fed-put this year. Actually, it used to be known as the Greenspan-put, then the Bernanke-put, then the Yellen-put. I’ve resigned to calling it the Fed-put until we have a Federal Reserve chair that bucks the trend. A put is a type of option contract that can be used to protect your investment from downside risk. Our central bank, and others around the world, has intervened in a massive way this year. Stimulus from Congress has also been monumental, effectively turning a depression scenario into what has so far felt more like a mild recession. We certainly acknowledge that this economic downturn has likely felt more like a depression for many, but on the whole government stimulus has been successful in avoiding a broader fallout. The Fed-put remains intact as the implicit understanding that the central bank will intervene if the economy isn’t growing at an acceptable pace or if the financial market is in crisis.

Facing limited choices for growth, investors are likely to continue to seek out stocks and potentially push areas of the stock market beyond what might be deemed a reasonable valuation. The uncertainty facing the economy and of simply investing in the stock market will also likely keep demand for lower-risk assets, like bonds, high despite the low level of yields on these investments.

In this type of environment, we believe that the temptation to time the market will be heightened. Holding assets in low-yielding, lower-risk bonds will be difficult when certain parts of the stock market or certain stocks attract significant attention for rising rapidly. Likewise, as certain stocks rise to seemingly unreasonable levels, the urge to avoid the potential collapse may be acute regardless of the actual exposure to those stocks.

We are remaining disciplined in our investment strategy during this period of heightened uncertainty. The disconnection between the stock market and day-to-day reality is prominent, but that doesn’t necessarily make it unjustified or predictable. As you may know, at Birchwood we operate as a team. This team structure has many benefits, including providing a forum to help ensure that we are making sound, objective decisions on your behalf and for your investment portfolio. In a world that feels very disconnected, we are working hard to stay connected and grounded through each other to help provide you with peace of mind.

Table 1

| Market Indices (As Of 6/30/20) | 2nd Quarter | One Year |

| Dow Jones Industrial Average | +18.5% | -0.5% |

| NASDAQ Composite | +31.0% | +26.9% |

| S&P 500 Index | +20.5% | +7.5% |

| Bloomberg Barclays Capital Aggregate Bond Index | +2.9% | +8.7% |

| Small Cap Stock (Russell 2000 Index) | +25.4% | -6.6% |

| Non-US Stock (MSCI EAFE Index) | +14.9% | -5.1% |

Each of us at Birchwood found this profession from a place of wanting to be of service to others. We miss seeing so many of you in person and very much look forward to that day, whenever it may come. Please know that we are here for you and we understand that the disruption of all our lives this year is weighing on everyone differently. If it would be helpful to review your financial situation or just to connect, please don’t hesitate to reach out to us.

Gratefully yours,

Steve Dixon, CFA®, Investment Manager

Kay Kramer, CFP®, Dana Brewer, CFP®, Bridget Handke, CFP®, Damian Winther, CFP® CSRICTM, Rachel Infante, CFP® CSRICTM

Sources

1 Source: U.S. Employment and Training Administration, Continued Claims (Insured Unemployment) [CCSA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CCSA. Accessed August 5, 2020.

2 Source: Siegel, Rachel and Van Dam, Andrew. “U.S. economy contracted at fastest quarterly rate on record from April to June as coronavirus walloped workers, businesses”. https://www.washingtonpost.com/business/2020/07/30/gdp-q2-coronavirus. Accessed August 5, 2020.

3 Source: Morningstar. The S&P 500 Index is used as a proxy for the U.S. stock market. Market indexes are unmanaged, and investors cannot invest directly in indexes. However, this index is an accurate reflection of the performance of the U.S. stock market. Returns reflect past performance and should not be considered indicative of future results.

4 Source: Investment Company Institute. Long-Term Mutual Fund and Exchange-Traded Fund (ETF) Flows. Accessed August 6, 2020.

Chart 1 Source: Morningstar, Birchwood Financial Partners. Return for the S&P 500 Index includes reinvested dividends. Yield on the iShares Core U.S. Aggregate Bond ETF is used as a proxy for the U.S. bond market. Market indexes are unmanaged, and investors cannot invest directly in indexes. However, these indexes are accurate reflections of the performance of the individual asset classes shown. All returns reflect past performance and should not be considered indicative of future results.

Table 1 Source: Morningstar. Market indexes are unmanaged, and investors cannot invest directly in indexes. However, these indexes are accurate reflections of the performance of the individual asset classes shown. All returns reflect past performance and should not be considered indicative of future results.